MARKET STATS

Canadian housing starts trended lower in October(2019.11.12)

The trend in housing starts was 218,598 units in October 2019, compared to 223,276 units in September 2019, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"The national trend in housing starts decreased in October," said Bob Dugan, CMHC's chief economist. "Multi-family starts in urban centres trended lower following four months of consecutive gains, offsetting a modest increase in the trend of urban single-detached starts in October".

Monthly Highlights

Vancouver

Housing starts in Vancouver Census Metropolitan Area (CMA) trended lower in October 2019 compared to October 2018, driven by a 15% decline in the multi-units sector. However, the year-to-date multi-units starts, mostly concentrated in the City of Vancouver and the City of Surrey, was up 31% compared to the same period last year, contributing to an increase of total starts between 2018 and 2019.

Kelowna

Housing starts in the Kelowna CMA were up significantly in October, relative to the same month last year, as some new large multi-unit projects got underway. In particular, a large number of rental apartment units got underway representing 73% of the overall number of multi-unit starts in the month of October. The number of rental units that have gotten underway in October represents the first meaningful increase in rental housing starts in over a year.

Edmonton

Total housing starts increased in the Edmonton CMA in October 2019 as multi-family unit construction more than doubled compared to the same month last year. This increased occurred across all multi-family housing types, with the largest increase occurring in apartment units. Year-to-date, new housing construction continues to increase, despite elevated inventory levels.

Regina

Total housing starts in Regina trended higher in October after builders increased the pace of single-detached construction. Despite the increase in the six-month trend, actual residential starts have declined by 57%, year-to-date, from the same period in 2018. The reduction is due to a number of factors including elevated new housing inventory, moderate economic conditions, higher construction costs and weaker new home demand.

Thunder Bay

The trend for overall housing starts in the Thunder Bay CMA increased considerably in October due almost entirely to an increase in the trend for apartment starts. Notably, the trend measure for apartment starts reached its highest level in nearly two years due to October rental apartment construction. Supporting this increase has been growth in the population aged 65 and over, the fastest growing segment of the population, and a group with a relatively high propensity to rent.

Toronto

Total housing starts trended slightly lower in October due to lower multi-unit home starts. Strong pre-construction sales of condominium apartments over the past two years continue to break ground at a varying pace throughout this year. Pre-construction sales of single-detached homes trended higher towards the latter half of 2018 and these units have started to break ground over the past several months, thus reflected by their higher trending starts.

Hamilton

In Hamilton CMA, overall housing starts trended up due to greater activity in both single-detached and multi-unit homes. The increase in the latter was mostly the result of a higher number of apartment starts over the past six months. A shift in homeownership demand towards lower priced homes and persistently strong rental demand have both supported the high level of apartment construction in Hamilton.

Gatineau

In October 2019, housing starts in the Gatineau region reached their highest level in almost 50 years, reinforcing the significant growth observed since the beginning of the year. This significant gain is mainly attributable to the increase in housing starts destined for the rental market. The aging of the population and the low vacancy rate continue to stimulate rental housing starts in the Gatineau region.

Sherbrooke

Since the beginning of the year, residential construction activity has been particularly strong in the Sherbrooke CMA. From January to October 2019, housing starts recorded in the region increased by 44% over the same period last year. The increase in activity comes mainly from the rental segment, with the launch of traditional rental housing projects and residences for seniors. Overall, residential construction in the region continues to be supported by rising full-time employment, migration and an aging population.

Prince Edward Island (PEI)

PEI housing starts were 146% higher this October compared to October 2018. This is due to the ongoing surge in new apartment construction activity in response to the Island's near zero vacancy rate and affordable rental needs. So far this year, starts are 68% higher than 2018. This trend reflects primarily increased capital project spending and solid growth in population, income and employment.

CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and obtain a more complete picture of Canada's housing market. In some situations, analyzing only SAAR data can be misleading, as they are largely driven by the multi-unit segment of the market which can vary significantly from one month to the next.

The standalone monthly SAAR of housing starts for all areas in Canada was 201,973 units in October, down 8.7% from 221,135 units in September. The SAAR of urban starts decreased by 9.0% in October to 189,304 units. Multiple urban starts decreased by 12.5% to 139,518 units in October while single-detached urban starts increased by 2.4% to 49,786 units.

Rural starts were estimated at a seasonally adjusted annual rate of 12,669 units.

"The national trend in housing starts decreased in October," said Bob Dugan, CMHC's chief economist. "Multi-family starts in urban centres trended lower following four months of consecutive gains, offsetting a modest increase in the trend of urban single-detached starts in October".

Monthly Highlights

Vancouver

Housing starts in Vancouver Census Metropolitan Area (CMA) trended lower in October 2019 compared to October 2018, driven by a 15% decline in the multi-units sector. However, the year-to-date multi-units starts, mostly concentrated in the City of Vancouver and the City of Surrey, was up 31% compared to the same period last year, contributing to an increase of total starts between 2018 and 2019.

Kelowna

Housing starts in the Kelowna CMA were up significantly in October, relative to the same month last year, as some new large multi-unit projects got underway. In particular, a large number of rental apartment units got underway representing 73% of the overall number of multi-unit starts in the month of October. The number of rental units that have gotten underway in October represents the first meaningful increase in rental housing starts in over a year.

Edmonton

Total housing starts increased in the Edmonton CMA in October 2019 as multi-family unit construction more than doubled compared to the same month last year. This increased occurred across all multi-family housing types, with the largest increase occurring in apartment units. Year-to-date, new housing construction continues to increase, despite elevated inventory levels.

Regina

Total housing starts in Regina trended higher in October after builders increased the pace of single-detached construction. Despite the increase in the six-month trend, actual residential starts have declined by 57%, year-to-date, from the same period in 2018. The reduction is due to a number of factors including elevated new housing inventory, moderate economic conditions, higher construction costs and weaker new home demand.

Thunder Bay

The trend for overall housing starts in the Thunder Bay CMA increased considerably in October due almost entirely to an increase in the trend for apartment starts. Notably, the trend measure for apartment starts reached its highest level in nearly two years due to October rental apartment construction. Supporting this increase has been growth in the population aged 65 and over, the fastest growing segment of the population, and a group with a relatively high propensity to rent.

Toronto

Total housing starts trended slightly lower in October due to lower multi-unit home starts. Strong pre-construction sales of condominium apartments over the past two years continue to break ground at a varying pace throughout this year. Pre-construction sales of single-detached homes trended higher towards the latter half of 2018 and these units have started to break ground over the past several months, thus reflected by their higher trending starts.

Hamilton

In Hamilton CMA, overall housing starts trended up due to greater activity in both single-detached and multi-unit homes. The increase in the latter was mostly the result of a higher number of apartment starts over the past six months. A shift in homeownership demand towards lower priced homes and persistently strong rental demand have both supported the high level of apartment construction in Hamilton.

Gatineau

In October 2019, housing starts in the Gatineau region reached their highest level in almost 50 years, reinforcing the significant growth observed since the beginning of the year. This significant gain is mainly attributable to the increase in housing starts destined for the rental market. The aging of the population and the low vacancy rate continue to stimulate rental housing starts in the Gatineau region.

Sherbrooke

Since the beginning of the year, residential construction activity has been particularly strong in the Sherbrooke CMA. From January to October 2019, housing starts recorded in the region increased by 44% over the same period last year. The increase in activity comes mainly from the rental segment, with the launch of traditional rental housing projects and residences for seniors. Overall, residential construction in the region continues to be supported by rising full-time employment, migration and an aging population.

Prince Edward Island (PEI)

PEI housing starts were 146% higher this October compared to October 2018. This is due to the ongoing surge in new apartment construction activity in response to the Island's near zero vacancy rate and affordable rental needs. So far this year, starts are 68% higher than 2018. This trend reflects primarily increased capital project spending and solid growth in population, income and employment.

CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and obtain a more complete picture of Canada's housing market. In some situations, analyzing only SAAR data can be misleading, as they are largely driven by the multi-unit segment of the market which can vary significantly from one month to the next.

The standalone monthly SAAR of housing starts for all areas in Canada was 201,973 units in October, down 8.7% from 221,135 units in September. The SAAR of urban starts decreased by 9.0% in October to 189,304 units. Multiple urban starts decreased by 12.5% to 139,518 units in October while single-detached urban starts increased by 2.4% to 49,786 units.

Rural starts were estimated at a seasonally adjusted annual rate of 12,669 units.

Rebound continues as home sales jump across Canada amid affordability concerns(2019.10.16)

Canada’s home sales jumped 15.5 per cent in September compared with last year, with rising activity and record prices in Toronto and its surrounding suburbs adding to affordability concerns that have become a focus in the federal election campaign.

Sales activity grew 21 per cent in the Toronto region and 45 per cent in the Vancouver area, underpinning the year-over-year increase to 41,819 home sales nationwide, according to a report from the Canadian Real Estate Association (CREA). It’s the seventh straight month that the country’s home sales have grown after hitting a six-year low in February, in part due to tougher mortgage requirements and a tax on foreign purchases of real estate in Vancouver and Toronto.

As sales activity has increased across the country, so have prices. CREA’s composite benchmark home price, an industry representation of the typical home sold, which includes detached houses, townhouses and condos, climbed slightly more than 1 per cent to $629,200 in September, compared with last year.

In the Toronto region, which includes the city and its outskirts, the benchmark home price was up 5 per cent to a record high of $806,700. In the Greater Vancouver Area, prices were down 7 per cent to $986,500, year over year, but were higher than in August, suggesting the market is rebounding from the B.C. government’s anti-speculation policies.

High housing prices became an issue early in the campaign for next Monday’s federal election, with all major parties promising to improve affordability, particularly for first-time buyers.

Nik Nanos, founder and chief data scientist of Nanos Research, said housing continues to be a major issue in the suburban Toronto and Vancouver areas.

“Housing affordability is definitely on the radar for voters, especially in those two regions which are in play, and also just have a tougher housing market,” he said.

Sales activity and prices are especially strong around Toronto, the CREA data indicate.

In the Oakville-Milton area, the composite benchmark home price rose 4 per cent to $1,026,300 last month, the real estate association said. In the Hamilton-Burlington area, home prices rose 7 per cent to $620,700. In the Niagara region, home prices increased 8 per cent to $423,300.

“We have a situation where those areas are becoming unaffordable,” said Benjamin Tal, deputy chief economist at CIBC. Even in Vancouver, Mr. Tal said: “The fact that prices went down [compared to 2018], doesn’t mean that it became affordable.”

Home prices in the southwestern Toronto suburbs have reached a record high. The price of a detached house in the Hamilton-Burlington region reached $656,300 last month. In Niagara, the price was nearly $450,000.

“If you have your heart set on buying a home, but you can’t afford or qualify for a mortgage financing in an area that you would most like to, you look at your second best. For that reason, people are driving further afield to places where they can qualify for financing,” CREA’s chief economist Gregory Klump said.

Investors are also fleeing to the suburbs, and that interest is contributing to housing boom outside Toronto.

“They are now moving funds into the St. Catharines and Niagara market,” said Brian Hogben, a mortgage broker who serves the Hamilton area. “The upswing potential is still quite large.”

The federal Liberals have proposed expanding a first-time home buyer plan to make it easier for people to buy in the expensive cities of Victoria, Vancouver and Toronto. Currently, Ottawa provides an interest-free loan of up to 10 per cent of the down payment, with a cap on the price.

The Conservatives and the New Democratic Party are proposing to extend the possible amortization period for an insured mortgage to 30 years from 25.

The Conservatives have also proposed to change the test that requires borrowers to prove they could handle home loan payments at a higher rate. It is unclear how they would change the test, which reduced the size of mortgages buyers could get.

Some critics have warned that measures to improve affordability such as lengthening the amortization period could push home prices higher and exacerbate the crisis.

“Lowering monthly mortgage payments by stretching repayment over a longer time period looks great on the surface, yet a surge in new buyers could cause prices to escalate, erasing the enhanced purchasing power,” Phil Soper, president of realtor Royal LePage, said in a recent press release.

In addition to Toronto and Vancouver, sales transactions were up in Calgary, Edmonton, Winnipeg, Ottawa and Montreal. (The Globe and Mail, Rachelle Younglai)

Sales activity grew 21 per cent in the Toronto region and 45 per cent in the Vancouver area, underpinning the year-over-year increase to 41,819 home sales nationwide, according to a report from the Canadian Real Estate Association (CREA). It’s the seventh straight month that the country’s home sales have grown after hitting a six-year low in February, in part due to tougher mortgage requirements and a tax on foreign purchases of real estate in Vancouver and Toronto.

As sales activity has increased across the country, so have prices. CREA’s composite benchmark home price, an industry representation of the typical home sold, which includes detached houses, townhouses and condos, climbed slightly more than 1 per cent to $629,200 in September, compared with last year.

In the Toronto region, which includes the city and its outskirts, the benchmark home price was up 5 per cent to a record high of $806,700. In the Greater Vancouver Area, prices were down 7 per cent to $986,500, year over year, but were higher than in August, suggesting the market is rebounding from the B.C. government’s anti-speculation policies.

High housing prices became an issue early in the campaign for next Monday’s federal election, with all major parties promising to improve affordability, particularly for first-time buyers.

Nik Nanos, founder and chief data scientist of Nanos Research, said housing continues to be a major issue in the suburban Toronto and Vancouver areas.

“Housing affordability is definitely on the radar for voters, especially in those two regions which are in play, and also just have a tougher housing market,” he said.

Sales activity and prices are especially strong around Toronto, the CREA data indicate.

In the Oakville-Milton area, the composite benchmark home price rose 4 per cent to $1,026,300 last month, the real estate association said. In the Hamilton-Burlington area, home prices rose 7 per cent to $620,700. In the Niagara region, home prices increased 8 per cent to $423,300.

“We have a situation where those areas are becoming unaffordable,” said Benjamin Tal, deputy chief economist at CIBC. Even in Vancouver, Mr. Tal said: “The fact that prices went down [compared to 2018], doesn’t mean that it became affordable.”

Home prices in the southwestern Toronto suburbs have reached a record high. The price of a detached house in the Hamilton-Burlington region reached $656,300 last month. In Niagara, the price was nearly $450,000.

“If you have your heart set on buying a home, but you can’t afford or qualify for a mortgage financing in an area that you would most like to, you look at your second best. For that reason, people are driving further afield to places where they can qualify for financing,” CREA’s chief economist Gregory Klump said.

Investors are also fleeing to the suburbs, and that interest is contributing to housing boom outside Toronto.

“They are now moving funds into the St. Catharines and Niagara market,” said Brian Hogben, a mortgage broker who serves the Hamilton area. “The upswing potential is still quite large.”

The federal Liberals have proposed expanding a first-time home buyer plan to make it easier for people to buy in the expensive cities of Victoria, Vancouver and Toronto. Currently, Ottawa provides an interest-free loan of up to 10 per cent of the down payment, with a cap on the price.

The Conservatives and the New Democratic Party are proposing to extend the possible amortization period for an insured mortgage to 30 years from 25.

The Conservatives have also proposed to change the test that requires borrowers to prove they could handle home loan payments at a higher rate. It is unclear how they would change the test, which reduced the size of mortgages buyers could get.

Some critics have warned that measures to improve affordability such as lengthening the amortization period could push home prices higher and exacerbate the crisis.

“Lowering monthly mortgage payments by stretching repayment over a longer time period looks great on the surface, yet a surge in new buyers could cause prices to escalate, erasing the enhanced purchasing power,” Phil Soper, president of realtor Royal LePage, said in a recent press release.

In addition to Toronto and Vancouver, sales transactions were up in Calgary, Edmonton, Winnipeg, Ottawa and Montreal. (The Globe and Mail, Rachelle Younglai)

10月全加房銷增12.9% 平均樓價按年升5.8%(2019.11.16)

星島日報訊

據最新報告指出,全國房屋銷售於10月份保持穩定,未經季度調整實際交易按年升12.9%。新放盤物業數目按月下降1.8%,電腦多重放盤系統(MLS)的房屋價格指數(HPI),分別按月升0.6%及按年升1.8%。未經季度調整全國平均銷售價按年攀升5.8%。

這是由加拿大地產協會(CREA)公布的數據,自3月開始一系列月度增長後,通過電腦多重放盤系統錄得全國房屋銷售,於10月份保持穩定。交易活動比今年2月時的6年低點高出近20%,但比2016年和2017年的高位則低了7%。

各地市場交易活動的增減情況,幾乎可一分為二。如大溫哥華地區、鄰近的菲沙河谷和渥太華的銷售增長,與大多倫多地區相抵銷,特別是在多倫多中部地區和咸美頓-伯靈頓地區的成交活動逐月減少。未經季度調整實際交易按年升12.9%,10月有80%各地市場的成交量比去年上升,包括所有大都會市場。

該會總裁賈史提芬(Jason Stephen)表示,10月份全國成交活動保持穩定,蓋過壓力測試對眾多地區樓市的拖累,在這些市場上供需之間的平衡,有利置業者進行購房洽談。

草原省份紐省為完全買方市場

首席經濟分析師克蘭普(Gregory Klump)稱,貫穿草原省份以及紐芬蘭省,均為完全買方市場。買家在洽談中佔據上風,申請按揭的壓力測試為合資格的買家減少了競爭者。

新放盤物業數目按月下調1.8%,大倫多地區和渥太華的跌幅最大。在所有樓房市場中,近三分一的市場按月下降最少5%,而在所有市場中大約五分一的市場按月增長最少5%。由於穩定的銷售及較少的新盤數量,兩者的比例進一步收緊至63.7%,逐漸超過長期平均水平53.6%。

在全國樓市平衡措施下,安省、魁北克省及海洋省份買家在二手盤的競爭,已使價格有所增長;而卑詩低陸平原的市場同樣也趨於平衡。大溫哥華地區及鄰近菲沙河谷的樓價逐漸回復,安省大金馬蹄地區價格出現增長反彈。

10月份房屋價格指數所有房屋類別均呈現增長。其中兩層獨立房屋價格上漲最多,按年升2.5%。單層單戶住宅價格按年升1.4%,而鎮屋及多層柏文單位分別上升1%及1.2%。

未經季度調整下,10月全國房屋銷售平均價格約為52.5萬元,比去年同期升5.8%。但全國平均價格深受大溫地區及大多地區的影響,在排除這兩個市場後,全國平均價格則下降接近125,000元,均價約為400,000元,按年下降4.7%。

據最新報告指出,全國房屋銷售於10月份保持穩定,未經季度調整實際交易按年升12.9%。新放盤物業數目按月下降1.8%,電腦多重放盤系統(MLS)的房屋價格指數(HPI),分別按月升0.6%及按年升1.8%。未經季度調整全國平均銷售價按年攀升5.8%。

這是由加拿大地產協會(CREA)公布的數據,自3月開始一系列月度增長後,通過電腦多重放盤系統錄得全國房屋銷售,於10月份保持穩定。交易活動比今年2月時的6年低點高出近20%,但比2016年和2017年的高位則低了7%。

各地市場交易活動的增減情況,幾乎可一分為二。如大溫哥華地區、鄰近的菲沙河谷和渥太華的銷售增長,與大多倫多地區相抵銷,特別是在多倫多中部地區和咸美頓-伯靈頓地區的成交活動逐月減少。未經季度調整實際交易按年升12.9%,10月有80%各地市場的成交量比去年上升,包括所有大都會市場。

該會總裁賈史提芬(Jason Stephen)表示,10月份全國成交活動保持穩定,蓋過壓力測試對眾多地區樓市的拖累,在這些市場上供需之間的平衡,有利置業者進行購房洽談。

草原省份紐省為完全買方市場

首席經濟分析師克蘭普(Gregory Klump)稱,貫穿草原省份以及紐芬蘭省,均為完全買方市場。買家在洽談中佔據上風,申請按揭的壓力測試為合資格的買家減少了競爭者。

新放盤物業數目按月下調1.8%,大倫多地區和渥太華的跌幅最大。在所有樓房市場中,近三分一的市場按月下降最少5%,而在所有市場中大約五分一的市場按月增長最少5%。由於穩定的銷售及較少的新盤數量,兩者的比例進一步收緊至63.7%,逐漸超過長期平均水平53.6%。

在全國樓市平衡措施下,安省、魁北克省及海洋省份買家在二手盤的競爭,已使價格有所增長;而卑詩低陸平原的市場同樣也趨於平衡。大溫哥華地區及鄰近菲沙河谷的樓價逐漸回復,安省大金馬蹄地區價格出現增長反彈。

10月份房屋價格指數所有房屋類別均呈現增長。其中兩層獨立房屋價格上漲最多,按年升2.5%。單層單戶住宅價格按年升1.4%,而鎮屋及多層柏文單位分別上升1%及1.2%。

未經季度調整下,10月全國房屋銷售平均價格約為52.5萬元,比去年同期升5.8%。但全國平均價格深受大溫地區及大多地區的影響,在排除這兩個市場後,全國平均價格則下降接近125,000元,均價約為400,000元,按年下降4.7%。

消費者置業信心增 屋價明年料升3.7%(2019.11.27)

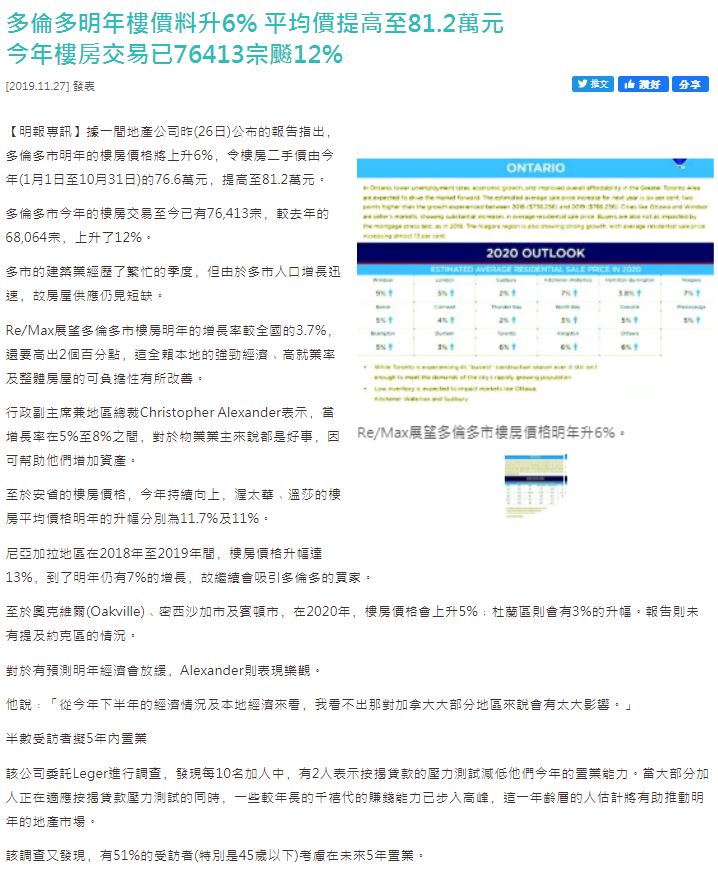

Re/Max的2020年房地產市場展望報告表示,有51%人計劃在未來5年置業,比去年同期的36%上升15%;當中45歲以下的人佔了相當比例。愈來愈多人適應房貸壓力測試,今年只有20%人認為測試對置業有負面影響。年紀較大的千禧世代邁入高薪,將成為明年市場的主要動力。

全國屋價今年有輕微上升,但安省個別地區的表現則超出正常增長,倫敦(London)升10.7%,溫莎(Windsor)升11%,渥太華升11.7%,尼亞加拉(Niagara)升12.9%。安省今年至目前為止,最高成交價的物業是奧克維爾(Oakville)的1,120,176元,最低交易價則是康和(Cornwall)的217,000元。

Re/Max副總裁兼安省-大西洋區域總監亞歷山大(Christopher Alexander)指出,南安省的屋價升勢強勁,部分地區仍然有雙位數的升幅。經濟穩健、人口增加和發展,將令明年的房地產市場更樂觀。

報告認為,安省失業率下降、經濟增長和大多倫多地區的房屋可負擔情況改善,均有利推動市場上揚。因此預期明年的平均屋價將有6%的增長,較去年和今年的升幅多2%。渥太華和溫莎的賣方市場,平均樓價有顯著上升。買家所受到的房貸壓力測試也較2018年為低。不少大多倫多地區的買家,選擇到尼亞加拉地區置業,促使當地的市道更強勁,平均屋價由2018年的平均378,517元,上升至今年的427,487元。

報告指出,雖然多倫多的建築業極為忙碌,但仍追不上人口急劇增長所帶來的巨大需求。渥太華、基秦拿-滑鐵盧和濕比利都預期受到庫存量低的影響。渥克維爾市的需求將主要來自細屋換大屋的買家。杜咸區、康和市及多倫多的市道則是被首次置業買家帶動。

溫西屋價明年料增4%

報告顯示,消費者在今年初對溫哥華西的信心極低,令當地平均屋價由去年的2,272,922.5元,下跌7.5%至2,103,234元,成交量也下降7%;但消費信心開始回復,明年的屋價將有4%的增長。雖然菲沙河谷的屋價也下跌4%至平均696,502.5元,但由於屋價相對比溫哥華更能夠負擔得起,因此吸引首次置業者入市。特別是素里市新增多個商業和教育機構,預期會促使樓市顯著增長。

Re/Max加西區域行政副總裁艾殊(Elton Ash)認為,卑詩省部分主要市場今年的銷售量下跌,是2018年樓市下滑的餘波。消費者已經回復信心,並適應了房貸壓力測試,況且明年也不預期利率會調高。(星岛)

全國屋價今年有輕微上升,但安省個別地區的表現則超出正常增長,倫敦(London)升10.7%,溫莎(Windsor)升11%,渥太華升11.7%,尼亞加拉(Niagara)升12.9%。安省今年至目前為止,最高成交價的物業是奧克維爾(Oakville)的1,120,176元,最低交易價則是康和(Cornwall)的217,000元。

Re/Max副總裁兼安省-大西洋區域總監亞歷山大(Christopher Alexander)指出,南安省的屋價升勢強勁,部分地區仍然有雙位數的升幅。經濟穩健、人口增加和發展,將令明年的房地產市場更樂觀。

報告認為,安省失業率下降、經濟增長和大多倫多地區的房屋可負擔情況改善,均有利推動市場上揚。因此預期明年的平均屋價將有6%的增長,較去年和今年的升幅多2%。渥太華和溫莎的賣方市場,平均樓價有顯著上升。買家所受到的房貸壓力測試也較2018年為低。不少大多倫多地區的買家,選擇到尼亞加拉地區置業,促使當地的市道更強勁,平均屋價由2018年的平均378,517元,上升至今年的427,487元。

報告指出,雖然多倫多的建築業極為忙碌,但仍追不上人口急劇增長所帶來的巨大需求。渥太華、基秦拿-滑鐵盧和濕比利都預期受到庫存量低的影響。渥克維爾市的需求將主要來自細屋換大屋的買家。杜咸區、康和市及多倫多的市道則是被首次置業買家帶動。

溫西屋價明年料增4%

報告顯示,消費者在今年初對溫哥華西的信心極低,令當地平均屋價由去年的2,272,922.5元,下跌7.5%至2,103,234元,成交量也下降7%;但消費信心開始回復,明年的屋價將有4%的增長。雖然菲沙河谷的屋價也下跌4%至平均696,502.5元,但由於屋價相對比溫哥華更能夠負擔得起,因此吸引首次置業者入市。特別是素里市新增多個商業和教育機構,預期會促使樓市顯著增長。

Re/Max加西區域行政副總裁艾殊(Elton Ash)認為,卑詩省部分主要市場今年的銷售量下跌,是2018年樓市下滑的餘波。消費者已經回復信心,並適應了房貸壓力測試,況且明年也不預期利率會調高。(星岛)

柏文獨立屋供應量偏低全國房價明年料漲3.2%(2019.12.13)

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Copyright© 2024, Markham Centre Realty Inc.,Brokerage. All Rights Reserved.

Designed & developed by La

Designed & developed by La