MARKET news

Why governments shouldn’t fiddle in the housing market(2019.10.21)

It’s human nature for people to see a problem and want to fix it.

Take the housing market, for example. All of the main parties, including the Liberals and Conservatives, campaigned hard in this election on the promise of making homes more affordable.

And with sales and prices rising again in many of the country’s hottest housing markets, a new government will be tempted to act early in its mandate.

That’s unfortunate. Meddling in the real-estate market – by making it easier for people to buy homes – is just as likely to make affordability worse. Artificially boosting demand risks exacerbating a shortage of available homes for sale in some areas.

Yes, real-estate prices have risen dramatically in cities such as Toronto and Vancouver in recent years. It’s also true that affordable rental units are hard to find in many markets.

But the evidence does not support the notion that Canada is facing a home ownership crisis worthy of government intervention.

More than 66 per cent of Canadian households currently own their home, according to TradingEconomics.com. That is down from a peak of 69 per cent in 2011. But it’s still higher than in most other developed countries.

Canada’s rate of home ownership is more than two full percentage points higher than in the United States, where there are generous tax incentives, including the ability to deduct mortgage interest from their taxable income.

Even in Toronto and Vancouver – the least affordable markets in Canada – home ownership rates are near the top among major cities around the world, the Royal Bank of Canada pointed out in a recent report. Ownership rates in those cities are double what they are in Paris and Berlin.

Younger buyers are also doing pretty well compared with their peers elsewhere. The ownership rate among under-35-year-olds in Canada was 43.1 per cent in 2016, or nearly 10 percentage points higher than in the U.S.

So the key question for the next government is: What is the problem that needs fixing?

In spite of offering no coherent answer to this question, both the Liberals and Conservatives are proposing new incentives for home buyers.

Andrew Scheer’s Conservatives, for example, would lower buyers’ monthly costs by letting them amortize insured mortgages over 30 years, up from the current limit of 25. Mr. Scheer is also promising to “fix” the mortgage stress test, introduced in 2018 by the Liberals, to deter Canadians from taking on too much debt, presumably by relaxing the rules.

The downside of the Conservative plan is that it risks encouraging Canadians to buy more expensive homes, take on excessive debt or both.

Liberal Leader Justin Trudeau says his government would implement and enhance a new $1.25-billion “shared-equity” program for first-time home buyers, announced in the March budget. Under the plan, Ottawa would offer interest-free loans covering up to 10 per cent of the down payment on a house in exchange for a proportional share of the future gains when the house is sold. The Liberals plan to boost the program’s house price limit to make it viable for buyers in the priciest cities of Toronto, Vancouver and Victoria.

The implicit assumption of both the Liberals and Conservatives is that more Canadians should own their own homes.

But neither party has offered a clear rationale for why raising the rate of home ownership is an appropriate policy goal. And if a two-thirds household ownership rate is too low, what is the appropriate level for Canada? Ninety per cent? One hundred per cent?

In China, more than 90 per cent of households own their homes, although these are typically small apartments, purchased with savings, rather than a mortgage. The Chinese are great savers and they place a high cultural value on owning real estate.

Canadians, on the other hand, generally take on a mortgage, and enduring debt obligations.

Renting is on the rise in North America, even for high-income earners. The Wall Street Journal reported last week that the share of U.S. households with six-figure incomes opting to rent rather than own has risen sharply since the 2006-07 housing crash. The newspaper said the trend is partly due to high prices and inadequate savings for a down payment, but also because some people want more disposable income and fewer home-maintenance responsibilities.

The next government would be wise to look at the bigger picture before doing anything further to stimulate home ownership in Canada. (FRED LUM/THE GLOBE AND MAIL)

Take the housing market, for example. All of the main parties, including the Liberals and Conservatives, campaigned hard in this election on the promise of making homes more affordable.

And with sales and prices rising again in many of the country’s hottest housing markets, a new government will be tempted to act early in its mandate.

That’s unfortunate. Meddling in the real-estate market – by making it easier for people to buy homes – is just as likely to make affordability worse. Artificially boosting demand risks exacerbating a shortage of available homes for sale in some areas.

Yes, real-estate prices have risen dramatically in cities such as Toronto and Vancouver in recent years. It’s also true that affordable rental units are hard to find in many markets.

But the evidence does not support the notion that Canada is facing a home ownership crisis worthy of government intervention.

More than 66 per cent of Canadian households currently own their home, according to TradingEconomics.com. That is down from a peak of 69 per cent in 2011. But it’s still higher than in most other developed countries.

Canada’s rate of home ownership is more than two full percentage points higher than in the United States, where there are generous tax incentives, including the ability to deduct mortgage interest from their taxable income.

Even in Toronto and Vancouver – the least affordable markets in Canada – home ownership rates are near the top among major cities around the world, the Royal Bank of Canada pointed out in a recent report. Ownership rates in those cities are double what they are in Paris and Berlin.

Younger buyers are also doing pretty well compared with their peers elsewhere. The ownership rate among under-35-year-olds in Canada was 43.1 per cent in 2016, or nearly 10 percentage points higher than in the U.S.

So the key question for the next government is: What is the problem that needs fixing?

In spite of offering no coherent answer to this question, both the Liberals and Conservatives are proposing new incentives for home buyers.

Andrew Scheer’s Conservatives, for example, would lower buyers’ monthly costs by letting them amortize insured mortgages over 30 years, up from the current limit of 25. Mr. Scheer is also promising to “fix” the mortgage stress test, introduced in 2018 by the Liberals, to deter Canadians from taking on too much debt, presumably by relaxing the rules.

The downside of the Conservative plan is that it risks encouraging Canadians to buy more expensive homes, take on excessive debt or both.

Liberal Leader Justin Trudeau says his government would implement and enhance a new $1.25-billion “shared-equity” program for first-time home buyers, announced in the March budget. Under the plan, Ottawa would offer interest-free loans covering up to 10 per cent of the down payment on a house in exchange for a proportional share of the future gains when the house is sold. The Liberals plan to boost the program’s house price limit to make it viable for buyers in the priciest cities of Toronto, Vancouver and Victoria.

The implicit assumption of both the Liberals and Conservatives is that more Canadians should own their own homes.

But neither party has offered a clear rationale for why raising the rate of home ownership is an appropriate policy goal. And if a two-thirds household ownership rate is too low, what is the appropriate level for Canada? Ninety per cent? One hundred per cent?

In China, more than 90 per cent of households own their homes, although these are typically small apartments, purchased with savings, rather than a mortgage. The Chinese are great savers and they place a high cultural value on owning real estate.

Canadians, on the other hand, generally take on a mortgage, and enduring debt obligations.

Renting is on the rise in North America, even for high-income earners. The Wall Street Journal reported last week that the share of U.S. households with six-figure incomes opting to rent rather than own has risen sharply since the 2006-07 housing crash. The newspaper said the trend is partly due to high prices and inadequate savings for a down payment, but also because some people want more disposable income and fewer home-maintenance responsibilities.

The next government would be wise to look at the bigger picture before doing anything further to stimulate home ownership in Canada. (FRED LUM/THE GLOBE AND MAIL)

5%, 10%, 20%: Down payment makes difference(2019.10.21)

Housing prices are ticking up again, with the average price for homes sold in September in the GTA reaching $843,115, according to the latest report.

Rising prices present prospective home buyers with a dilemma when it comes to saving for a down payment. Putting down the minimum five per cent on a $500,000 home gets you into the housing market for a reasonable $25,000. Saving up a 20 per cent down payment, on the other hand, avoids costly mortgage default insurance premiums (mortgage loan insurance from Canada Mortgage and Housing Corporation).

Note that the minimum amount required for a down payment depends on the purchase price of your home. Homes valued at $500,000 or less need a down payment of five per cent, while homes valued between $500,000 and $999,999 require five per cent on the first $500,000 and 10 per cent for the portion above $500,000. Home buyers need to put down 20 per cent on homes valued at $1 million or more.

There are pros and cons putting down more or less on your home purchase. I reached out to Robert McLister, mortgage expert and founder of RateSpy.com, to discuss house down payment options. Five per cent down Pros: The obvious advantage to making the minimum five per cent down payment is there’s less capital required to become a home owner and reaching that threshold requires less time to save.

“So many young buyers stay on the sidelines scrimping for a bigger down payment only to see home prices run away from them,” says McLister.

He points to the past two decades of price growth as evidence that getting into the market quicker can pay off, “provided homebuyers don’t overextend themselves.”

Putting down less than 20 per cent requires the buyer to purchase mortgage loan insurance to protect the lender against default.

While the borrower must pay those insurance premiums, McLister says an advantage to having an insured mortgage is that it gives purchasers access to the lowest interest rates available. A five per cent down payment is also compatible with the First Time Home Buyers’ Incentive – the shared equity mortgage with the Government of Canada – and other governmental home subsidies.

A deliberately smaller down payment can leave a borrower with a larger cash cushion, saving for more immediate closing costs and furnishings, or simply retaining more money for emergencies and other needs.

Cons: The financial impact of putting the minimum amount down on your home is that it comes with a four per cent default insurance premium. While this amount can be rolled into the mortgage, it creates a highly leveraged situation with risk of negative equity should home prices fall.

“On Day One you’re almost 99 per cent financed. It doesn’t take much of a home price selloff to trap you in your home, preventing a sale,” he said.

A five per cent down payment also means more interest expense over the life of your mortgage, compared to a larger down payment.

A caveat to consider: Prospective home buyers can borrow the five per cent down payment (even from a credit card) so long as they meet the lender’s debt limit ratio.

The big red flag on this means, “they can essentially owe more than their home price on Day One,” McLister said. 20 per cent down Pros: The primary advantage of putting down 20 per cent or more on a home is to avoid default insurance premiums, saving thousands of dollars over the life of the mortgage.

A larger down payment offers more flexibility, giving buyers the ability to purchase a home priced at $1million or more, and allowing for amortizations over 25 years, along with refinancing.

Putting 20 per cent down gives buyers more product choices, such as re-advanceable mortgages, standalone home equity lines of credit, interestonly mortgages and non-prime financing.

Buyers with 20 per cent down also avoid the federal mortgage stress tests if they use a credit union or alternative lender.

Cons: A 20 per cent down payment ties up more of an investor’s capital, which comes with an opportunity cost — there will be less money for moving costs or renovations.

It also subjects most borrowers to a stricter stress test if they use a bank, since the mortgage would be uninsured.

“The uninsured stress test equals the greater of the (Bank of Canada’s) benchmark rate or your contract rate plus two per cent, whereas the insured stress test is just the benchmark rate,” McLister said.

In summary, McLister said, the size of the down payment shouldn’t only be dictated by available resources, but by investment alternatives.

“Often times it makes more sense to put less down so you can allocate cash to purposes with a higher return on investment.”

A deliberately smaller down payment can leave a borrower with a larger cash cushion ( Toronto Star, Robb Engen)

Rising prices present prospective home buyers with a dilemma when it comes to saving for a down payment. Putting down the minimum five per cent on a $500,000 home gets you into the housing market for a reasonable $25,000. Saving up a 20 per cent down payment, on the other hand, avoids costly mortgage default insurance premiums (mortgage loan insurance from Canada Mortgage and Housing Corporation).

Note that the minimum amount required for a down payment depends on the purchase price of your home. Homes valued at $500,000 or less need a down payment of five per cent, while homes valued between $500,000 and $999,999 require five per cent on the first $500,000 and 10 per cent for the portion above $500,000. Home buyers need to put down 20 per cent on homes valued at $1 million or more.

There are pros and cons putting down more or less on your home purchase. I reached out to Robert McLister, mortgage expert and founder of RateSpy.com, to discuss house down payment options. Five per cent down Pros: The obvious advantage to making the minimum five per cent down payment is there’s less capital required to become a home owner and reaching that threshold requires less time to save.

“So many young buyers stay on the sidelines scrimping for a bigger down payment only to see home prices run away from them,” says McLister.

He points to the past two decades of price growth as evidence that getting into the market quicker can pay off, “provided homebuyers don’t overextend themselves.”

Putting down less than 20 per cent requires the buyer to purchase mortgage loan insurance to protect the lender against default.

While the borrower must pay those insurance premiums, McLister says an advantage to having an insured mortgage is that it gives purchasers access to the lowest interest rates available. A five per cent down payment is also compatible with the First Time Home Buyers’ Incentive – the shared equity mortgage with the Government of Canada – and other governmental home subsidies.

A deliberately smaller down payment can leave a borrower with a larger cash cushion, saving for more immediate closing costs and furnishings, or simply retaining more money for emergencies and other needs.

Cons: The financial impact of putting the minimum amount down on your home is that it comes with a four per cent default insurance premium. While this amount can be rolled into the mortgage, it creates a highly leveraged situation with risk of negative equity should home prices fall.

“On Day One you’re almost 99 per cent financed. It doesn’t take much of a home price selloff to trap you in your home, preventing a sale,” he said.

A five per cent down payment also means more interest expense over the life of your mortgage, compared to a larger down payment.

A caveat to consider: Prospective home buyers can borrow the five per cent down payment (even from a credit card) so long as they meet the lender’s debt limit ratio.

The big red flag on this means, “they can essentially owe more than their home price on Day One,” McLister said. 20 per cent down Pros: The primary advantage of putting down 20 per cent or more on a home is to avoid default insurance premiums, saving thousands of dollars over the life of the mortgage.

A larger down payment offers more flexibility, giving buyers the ability to purchase a home priced at $1million or more, and allowing for amortizations over 25 years, along with refinancing.

Putting 20 per cent down gives buyers more product choices, such as re-advanceable mortgages, standalone home equity lines of credit, interestonly mortgages and non-prime financing.

Buyers with 20 per cent down also avoid the federal mortgage stress tests if they use a credit union or alternative lender.

Cons: A 20 per cent down payment ties up more of an investor’s capital, which comes with an opportunity cost — there will be less money for moving costs or renovations.

It also subjects most borrowers to a stricter stress test if they use a bank, since the mortgage would be uninsured.

“The uninsured stress test equals the greater of the (Bank of Canada’s) benchmark rate or your contract rate plus two per cent, whereas the insured stress test is just the benchmark rate,” McLister said.

In summary, McLister said, the size of the down payment shouldn’t only be dictated by available resources, but by investment alternatives.

“Often times it makes more sense to put less down so you can allocate cash to purposes with a higher return on investment.”

A deliberately smaller down payment can leave a borrower with a larger cash cushion ( Toronto Star, Robb Engen)

a scramble for toronto properties(2019.10.16)

On a recent fall evening in the upscale Toronto neighbourhood of Forest Hill, four prospective buyers were vying for a gracious two-bedroom condo unit with an outdoor terrace.

The 1,600-square-foot unit was listed with an asking price of $1.6-million. Many empty nesters covet such properties, so real estate agent Andre Kutyan of Harvey Kalles Real Estate Ltd. – who represented one couple at the table – wasn’t surprised to face competition.

But Mr. Kutyan was shocked when he learned that one triumphant buyer had blown past the others with a bid of $2.1-million.

“We were beside ourselves with the price it got – it just doesn’t make any sense,” he says.

Mr. Kutyan says a dramatic lack of inventory in central and north Toronto is driving prices for large condo units upward at an exponential pace.

He estimated the unit at Lower Village Gate would fetch between $1.7-million and $1.8-million, based on previous sales in the building.

“I believe someone paid $300,000 or $400,000 more because they just had to have it,” he says.

Mr. Kutyan says that price has set a new bar.

“It’s going to put upward pressure on the next unit that comes up in the building.”

A large contingent of downsizing baby boomers is seeking apartments of 1,500 square feet and up. They have $1.5-million and more to spend, in many cases, because they’re selling a house in tony areas such as Forest Hill, Lawrence Park or Bayview and York Mills.

It’s a trend Mr. Kutyan sees intensifying as more boomers look to sell their large houses in the coming years.

“We’re at the beginning of this. There are tons of boomers out there who want this,” he says.

Recent market dynamics are not working in favour of the downsizers, says Mr. Kutyan, pointing to one swath of the market around Bayview and York Mills. In early October, buyers could choose from 136 listings with asking prices between $3-million and $8-million.

With so much supply, he points out, many of the empty nesters’ freehold homes have lost value in the past 12 to 24 months. In the best case scenario, the price of the detached house has stayed fairly flat – at the worst it’s tumbled 20 per cent to 30 per cent.

The price of the average condo in the 416 area code of Toronto, meanwhile, jumped 15 per cent in the two years to the end of September.

Robin Pope of Pope Real Estate Ltd. has listed a renovated three-bedroom penthouse at 47 Lower River St. for sale with an asking price of $1.845-million. The two-storey unit has 1,744 square feet of living space.

He figures it’s the kind of spacious unit that will appeal to downsizers.

Mr. Pope says many potential buyers have booked showings and two parties are coming back for a second time. But in the downtown area, he’s finding entry-level units are the most in demand.

“The $500,000 price point is just insanely hot – it’s ridiculous,” he says.

In the Beaches neighbourhood in Toronto’s east end, sales of houses priced at $2-million and up are picking up after a slow couple of years, says Rochelle DeClute of Union Realty Brokerage Inc.

“We’re seeing movement there again.”

But that action is fairly calm compared with the frenzy of 2016 and 2017, she adds.

“We don’t see that same kind of frantic behaviour that we had been seeing.”

She is seeing feverish behaviour in the condo market, however, as first-time buyers try to gain a toehold in the market. Many are buying into projects in the east end, she says, and saving more money during the four or five years the unit is under construction.

“They are frantic to get in there.”

At the other end of the market, where more mature buyers are on the hunt, Mr. Kutyan says he believes escalating prices are prompting downsizers to spend more now.

“There’s a sense of urgency with this demographic. They’re worried they’re going to be too late and miss out.”

In the Lower Village Gate project where Mr. Kutyan’s clients lost out, there have been only five sales in the two buildings in 2019.

Mr. Kutyan’s clients were ready with an offer well above the $1.6-million asking price, he says, because they had lost out on a unit in the same building one year ago and had been looking ever since.

The couple figured they would need to spend a minimum of $200,000 to renovate the unit.

The buyer who prevailed paid $1,312.56 a square foot for the unrenovated unit, Mr. Kutyan points out. The previous highest price in the building was $1176 a square foot, and that was for a renovated penthouse suite.

People who had planned to sell a house, buy a condo and have some money left over to spend in retirement are feeling the squeeze, he says.

“To get anything decent in the city of Toronto, you’re looking at $1,000 a square foot.”

Looking ahead, Capital Economics says the results of the upcoming federal election may bring some changes to the country’s housing market.

Both the Liberals and the Conservatives have proposed policies that could boost house prices after a decade of tightening lending restrictions, senior Canada economist Stephen Brown says.

Mr. Brown adds the effects of the proposals on house prices are likely to be small. Still, Canada’s household debt has continued to increase in the past 10 years, he says, and if the election were to mark the start of a pronounced shift in attitudes toward lending restrictions, it will rise further, he cautions.

Were a future government to loosen lending restrictions, Canada’s economic growth could rise in the short term, he says, but the economy would be even more vulnerable to a negative shock. ( The Globe and Mail, Carolyn Ireland)

The 1,600-square-foot unit was listed with an asking price of $1.6-million. Many empty nesters covet such properties, so real estate agent Andre Kutyan of Harvey Kalles Real Estate Ltd. – who represented one couple at the table – wasn’t surprised to face competition.

But Mr. Kutyan was shocked when he learned that one triumphant buyer had blown past the others with a bid of $2.1-million.

“We were beside ourselves with the price it got – it just doesn’t make any sense,” he says.

Mr. Kutyan says a dramatic lack of inventory in central and north Toronto is driving prices for large condo units upward at an exponential pace.

He estimated the unit at Lower Village Gate would fetch between $1.7-million and $1.8-million, based on previous sales in the building.

“I believe someone paid $300,000 or $400,000 more because they just had to have it,” he says.

Mr. Kutyan says that price has set a new bar.

“It’s going to put upward pressure on the next unit that comes up in the building.”

A large contingent of downsizing baby boomers is seeking apartments of 1,500 square feet and up. They have $1.5-million and more to spend, in many cases, because they’re selling a house in tony areas such as Forest Hill, Lawrence Park or Bayview and York Mills.

It’s a trend Mr. Kutyan sees intensifying as more boomers look to sell their large houses in the coming years.

“We’re at the beginning of this. There are tons of boomers out there who want this,” he says.

Recent market dynamics are not working in favour of the downsizers, says Mr. Kutyan, pointing to one swath of the market around Bayview and York Mills. In early October, buyers could choose from 136 listings with asking prices between $3-million and $8-million.

With so much supply, he points out, many of the empty nesters’ freehold homes have lost value in the past 12 to 24 months. In the best case scenario, the price of the detached house has stayed fairly flat – at the worst it’s tumbled 20 per cent to 30 per cent.

The price of the average condo in the 416 area code of Toronto, meanwhile, jumped 15 per cent in the two years to the end of September.

Robin Pope of Pope Real Estate Ltd. has listed a renovated three-bedroom penthouse at 47 Lower River St. for sale with an asking price of $1.845-million. The two-storey unit has 1,744 square feet of living space.

He figures it’s the kind of spacious unit that will appeal to downsizers.

Mr. Pope says many potential buyers have booked showings and two parties are coming back for a second time. But in the downtown area, he’s finding entry-level units are the most in demand.

“The $500,000 price point is just insanely hot – it’s ridiculous,” he says.

In the Beaches neighbourhood in Toronto’s east end, sales of houses priced at $2-million and up are picking up after a slow couple of years, says Rochelle DeClute of Union Realty Brokerage Inc.

“We’re seeing movement there again.”

But that action is fairly calm compared with the frenzy of 2016 and 2017, she adds.

“We don’t see that same kind of frantic behaviour that we had been seeing.”

She is seeing feverish behaviour in the condo market, however, as first-time buyers try to gain a toehold in the market. Many are buying into projects in the east end, she says, and saving more money during the four or five years the unit is under construction.

“They are frantic to get in there.”

At the other end of the market, where more mature buyers are on the hunt, Mr. Kutyan says he believes escalating prices are prompting downsizers to spend more now.

“There’s a sense of urgency with this demographic. They’re worried they’re going to be too late and miss out.”

In the Lower Village Gate project where Mr. Kutyan’s clients lost out, there have been only five sales in the two buildings in 2019.

Mr. Kutyan’s clients were ready with an offer well above the $1.6-million asking price, he says, because they had lost out on a unit in the same building one year ago and had been looking ever since.

The couple figured they would need to spend a minimum of $200,000 to renovate the unit.

The buyer who prevailed paid $1,312.56 a square foot for the unrenovated unit, Mr. Kutyan points out. The previous highest price in the building was $1176 a square foot, and that was for a renovated penthouse suite.

People who had planned to sell a house, buy a condo and have some money left over to spend in retirement are feeling the squeeze, he says.

“To get anything decent in the city of Toronto, you’re looking at $1,000 a square foot.”

Looking ahead, Capital Economics says the results of the upcoming federal election may bring some changes to the country’s housing market.

Both the Liberals and the Conservatives have proposed policies that could boost house prices after a decade of tightening lending restrictions, senior Canada economist Stephen Brown says.

Mr. Brown adds the effects of the proposals on house prices are likely to be small. Still, Canada’s household debt has continued to increase in the past 10 years, he says, and if the election were to mark the start of a pronounced shift in attitudes toward lending restrictions, it will rise further, he cautions.

Were a future government to loosen lending restrictions, Canada’s economic growth could rise in the short term, he says, but the economy would be even more vulnerable to a negative shock. ( The Globe and Mail, Carolyn Ireland)

toronto pushes for greener condos(2019.10.18)

When Oxford Properties breaks ground on The Hub, a 57-storey office tower located near the foot of Bay Street next to Toronto’s venerable Harbour Commission building, the OMERS-owned development giant will embarking on what it claims will become the first “net zero” office tower in Canada.

Set to open in 2024, the glass-and-column high-rise, designed by London-based Rogers Stirk Harbour + Partners, will feature a full suite of emission-reduction systems, including triple-glazed windows, LED lighting, rooftop solar and a “dedicated outdoor air” system that uncouples the heating and cooling mechanisms from the ventilation network, an efficiency-boosting approach to standard HVAC (Heating, Ventilation and Air Conditioning).

Darryl Neate, Oxford’s director of sustainability, says the designers are also scouting around for other savings, including recycling waste heat and even the purchase of carbon offsets. Oxford aims to have The Hub, which is part of a Canadian Green Building Council carbon pilot project, certified as a LEED Platinum building.

Such projects will help the City of Toronto make good on a voluntary plan announced by Mayor John Tory earlier this month to work with large land owners and developers to accelerate their energy savings and emission reductions by establishing five-year targets. By most estimates, buildings account for about 40 per cent of all carbon emissions from human sources.

The “Green Will” partnership so far involves several of the city’s largest landowners, with a combined footprint of more than 300 million square feet. The list includes the city, Toronto Community Housing, universities, hospitals, school boards as well as private developers such as Oxford, Cadillac Fairview and Brookfield.

But when Mr. Tory announced the plan, which calls for benchmarking, auditing and retrofit capital planning, the list of participants didn’t include condo developers and apartment building operators, such as Tridel, Greenwin Inc. or Shiplake Properties. (Oxford’s portfolio includes some mixed-use multiunit residential buildings.)

In an interview, Mr. Tory says he’s continuing to reach out to apartment building companies, and also hopes to enlist the thousands of small landlords who own low-rise commercial structures, such as medical arts buildings, a category he describes as the “toughest” to reach.

And while the Green Will strategy aims to demonstrate the city’s leadership, Scarborough councillor Jennifer McKelvie says, it’s clear that one other large category of property owners is conspicuously missing from the plan: homeowners.

“When you think of where the carbon is in buildings, it is largely in the existing stock,” says Corey McBurney, president of EnerQuality, a third-party certification organization that works with developers and auditors to verify the energy efficiency ratings of new residential buildings in Ontario. “What are we doing to lower [homeowners’] carbon footprint? To date, we haven’t done nearly enough.”

His point highlights one of several obstacles in the city’s attempt to accelerate its decarbonization goals over the next 20 to 30 years, and also reveals the very different approaches to energy efficiency management employed by different categories of property owners and builders.

In general, the Ontario Building Code and the recently updated Toronto Green Standard have set a fairly high bar for new buildings. All new development applications submitted after May, 2018, have had to meet the first tier of the green standard, which requires the dwelling to be 15 per cent more energy efficient than what’s specified in the OBC. Builders who voluntarily exceed that target can qualify for various financial incentives, such as development charge reductions.

But these codes have little to say about how property owners manage the carbon performance of existing buildings. Some asset managers, especially large office developers such as Brookfield, have been aggressive in recent years in driving down energy consumption, using a range of emerging technologies, including building automation systems. The savings go to the bottom line. Firms such as Oxford even tie their managers’ compensation packages to meeting or exceeding energy reduction targets. “It’s about holding people accountable for results,” Mr. Neate says.

Mr. McBurney says a growing number of homebuilders now design dwellings to meet the EnergyStar rating, which requires a home to be 20 per cent more efficient than the OBC. About half of all new homes now carry the rating, he adds, noting that EnerQuality recently extended this certification to multiunit high-rise buildings.

With homeowners and small contractors, however, the story is quite different, with a far larger range of results. Some poorly designed home renovations or rebuilds can boost energy consumption, or do little more than meet the building code requirements. Others feature all sorts of energy efficiency or renewable energy features, from tankless electric hot-water heaters to roof-top solar systems.

While Ms. McKelvie notes that Toronto offers loans for such projects, she feels there should be more incentives available, and adds that the city could also be doing more to facilitate such investments, for example by providing homeowners with information on how to do group purchases of roof-top solar systems in order to reduce prices.

Mr. Tory added that his office has reached out to large Canadian financial institutions about developing new lending instruments, such as “green mortgages,” which offer reduced terms for borrowers investing in home energy retrofits. He was recently in London, talking to British bankers about such products. “There’s huge interest there in financial projects to help with green projects,” he says.

The hesitant homeowner problem could take a turn after the federal election. In an interesting ideological alignment, all four major parties are promising various inducements, including $40,000 interest-free home energy retrofit loans (Liberals), a 20-per-cent tax credit on “green” improvements worth up to $3,800 on a $20,000 project (Conservatives) and low-interest loans with repayment terms tied to energy savings (NDP and Greens).

Reflecting on what he describes as the “voluntary collaboration” model that underpins initiatives such as Mr. Tory’s Green Will program, Mr. McBurney describes these efforts as “positive,” but doubts they are sufficient, given council’s goal of accelerating the city’s emission reduction targets in light of a worsening climate crisis. As he says, “I wonder if the city will take an even tougher line.”

This article is part of an occasional series about recent advances in sustainable design and construction. (The Globe and Mail, John Lorinc)

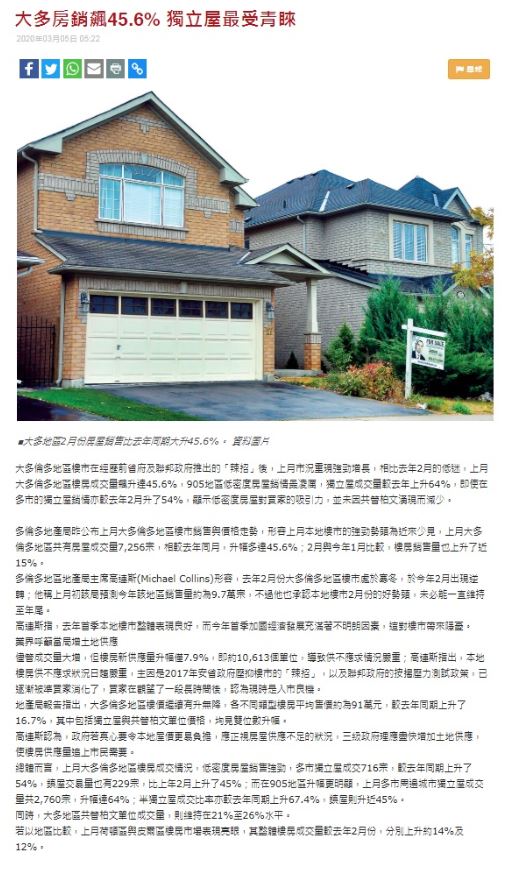

大麻合法化带动楼市,加东厂房附近销情旺(2019.10.16)

Your browser does not support viewing this document. Click here to download the document.

Time is now with GTA’s housing-supply crunch(2019.11.08)

Paragraph. 按此處以編輯.

夫婦誤買「發霉屋」險至破產 獲省府新屋保險賠償30萬元(2019.11.20)

【明報專訊】安省一對夫婦去年6月在不知情下﹐誤買「發霉屋」﹐直至2名幼女身體不適﹐始揭發真相。但保險公司以他們買入物業時﹐霉菌早已存在為由﹐拒絕賠償。夫婦二人只好入稟法院﹐向建築商索償。但雙方糾纏在訴訟時﹐夫婦須另租地方居住之餘﹐還要繼續支付「發霉屋」的按揭﹑地稅等﹐令他們財政不勝負荷。當兩人還有2個月﹐可能便被迫宣布破產時﹐卻出現奇蹟﹐夫婦獲得30萬元賠償。

保險公司拒賠償 與建築商打官司

給予賠償的﹐是省府屬下專門規管建築商及保護置業人士的安省新屋保險公司Tarion Warranty Corporation。當局經調查後﹐決定「發霉屋」這個案特殊﹐業主符合索賠資格。

奧斯汀夫婦Bridget Austin與Mike Austin帶着2名幼女於去年6月﹐由Grimsby鎮遷入他們位於Port Sydney的新居﹐但當四口子入住這個夢想之家後才數周﹐2名幼女便持續發燒﹐最後確診患有咽喉炎。夫婦其後很快便發現新居廚房地板﹑地庫天花板﹑牆板背後均布滿有毒黑色霉菌﹐新居根本不宜居住。

他們轉到Huntsville一個出租物業暫住。夫婦兩人其後才知道﹐「新居」並不「新」﹐屋齡遠超於他們所知。Port Sydney社區內有市民表示﹐該棟「發霉屋」早在2006年興建﹐與他們所知的是2016年所建有出入。

夫婦兩人入住新居時﹐曾找人來驗樓﹐但當時未有發現霉菌。保險公司則以夫婦二人買入「發霉屋」時﹐早有霉菌存在為由﹐拒絕賠償。

在別無選擇下﹐夫婦二人只好入稟法院﹐控告建築商為達成交易﹐不惜隱暪屋子發霉的事實,有關發展商則拒絕就事件置評。

在興訟期間﹐夫婦既要為臨時住所交租及水電費﹐又要繼續為「發霉屋」償還按揭貸款﹑支付地稅等。他們雖透過GoFundMe網籌﹐收集了8,000元捐款﹐但仍不足以彌補他們的開支。

奧斯汀一家的經濟只能再維持1﹑2個月﹐然後他們便要被迫宣布破產。眼見一家快要失去所有﹐奇蹟卻突然出現。

本月初﹐他們接到Tarion的消息﹐指他們可得到30萬元賠償。

Tarion發言人卡恩斯(Melanie Kearns)表示﹐當局就奧斯汀的個案進行調查﹐並斷定他們可得到賠償。

卡恩斯說﹕「奧斯汀的個案很罕有﹐他們新居霉菌的問題相當嚴重﹐建築商有責任確保房屋可適宜居住﹐而涉事的建築商既然拒絕補償﹐故我們決定介入﹐直接為受影響的家庭提供協助。」

雖然Tarion拒絕透露賠償金額﹐但奧斯汀則表示﹐他們最多可獲30萬元賠償額。

她形容這筆錢對他們來說是及時雨。

她又說﹐Tarion了解過後﹐發現清理全屋霉菌的費用﹐與將房子拆除再重建﹐相差不遠﹐遂決定讓他們重建房子﹐確保霉菌不會有機會再滋生。

不過﹐他們的問題還未完全解決﹐皆因他們已經問價﹐30萬元的賠償額只足夠讓他們將房子的主幹部分拆卸再重建﹐但要將全屋包括面積600平方呎的車房重建﹐工程費用便要47.5萬元。奧斯汀希望透過訴訟得到索償﹐填補多出來的建屋費。

他們計劃明春便開始重建工程﹐雖然新屋所佔面積與拆卸前一樣﹐但設計則會完全不同﹐以免家人喚起不愉快的經歷。(明报)

保險公司拒賠償 與建築商打官司

給予賠償的﹐是省府屬下專門規管建築商及保護置業人士的安省新屋保險公司Tarion Warranty Corporation。當局經調查後﹐決定「發霉屋」這個案特殊﹐業主符合索賠資格。

奧斯汀夫婦Bridget Austin與Mike Austin帶着2名幼女於去年6月﹐由Grimsby鎮遷入他們位於Port Sydney的新居﹐但當四口子入住這個夢想之家後才數周﹐2名幼女便持續發燒﹐最後確診患有咽喉炎。夫婦其後很快便發現新居廚房地板﹑地庫天花板﹑牆板背後均布滿有毒黑色霉菌﹐新居根本不宜居住。

他們轉到Huntsville一個出租物業暫住。夫婦兩人其後才知道﹐「新居」並不「新」﹐屋齡遠超於他們所知。Port Sydney社區內有市民表示﹐該棟「發霉屋」早在2006年興建﹐與他們所知的是2016年所建有出入。

夫婦兩人入住新居時﹐曾找人來驗樓﹐但當時未有發現霉菌。保險公司則以夫婦二人買入「發霉屋」時﹐早有霉菌存在為由﹐拒絕賠償。

在別無選擇下﹐夫婦二人只好入稟法院﹐控告建築商為達成交易﹐不惜隱暪屋子發霉的事實,有關發展商則拒絕就事件置評。

在興訟期間﹐夫婦既要為臨時住所交租及水電費﹐又要繼續為「發霉屋」償還按揭貸款﹑支付地稅等。他們雖透過GoFundMe網籌﹐收集了8,000元捐款﹐但仍不足以彌補他們的開支。

奧斯汀一家的經濟只能再維持1﹑2個月﹐然後他們便要被迫宣布破產。眼見一家快要失去所有﹐奇蹟卻突然出現。

本月初﹐他們接到Tarion的消息﹐指他們可得到30萬元賠償。

Tarion發言人卡恩斯(Melanie Kearns)表示﹐當局就奧斯汀的個案進行調查﹐並斷定他們可得到賠償。

卡恩斯說﹕「奧斯汀的個案很罕有﹐他們新居霉菌的問題相當嚴重﹐建築商有責任確保房屋可適宜居住﹐而涉事的建築商既然拒絕補償﹐故我們決定介入﹐直接為受影響的家庭提供協助。」

雖然Tarion拒絕透露賠償金額﹐但奧斯汀則表示﹐他們最多可獲30萬元賠償額。

她形容這筆錢對他們來說是及時雨。

她又說﹐Tarion了解過後﹐發現清理全屋霉菌的費用﹐與將房子拆除再重建﹐相差不遠﹐遂決定讓他們重建房子﹐確保霉菌不會有機會再滋生。

不過﹐他們的問題還未完全解決﹐皆因他們已經問價﹐30萬元的賠償額只足夠讓他們將房子的主幹部分拆卸再重建﹐但要將全屋包括面積600平方呎的車房重建﹐工程費用便要47.5萬元。奧斯汀希望透過訴訟得到索償﹐填補多出來的建屋費。

他們計劃明春便開始重建工程﹐雖然新屋所佔面積與拆卸前一樣﹐但設計則會完全不同﹐以免家人喚起不愉快的經歷。(明报)

Ontario Government Strengthens Trust in Real Estate Services(2019.11.19)

TORONTO — Today, the Ontario government introduced a bill proposing changes to the Real Estate and Business Brokers Act, 2002 that would, if passed by the legislature, modernize rules for registered real estate brokerages, brokers and salespersons.

"Real estate salespersons and brokers are the experts for home buyers and sellers," said Lisa Thompson, Minister of Government and Consumer Services. "Whether a transaction involves a fixer-upper, a move-in ready dream home or a commercial property, every consumer should know that the person they are dealing with is professional, knowledgeable and accountable."

Between January and March 2019, almost 7,000 consumers and real estate professionals responded to an online government survey and consultation paper about potential changes to the act. The Trust in Real Estate Services Act, if passed by the legislature would address the need for a stronger and more ethical business environment, to protect consumers when making their biggest purchase.

For example, the Act would:

"The Real Estate Council of Ontario (RECO) is pleased to have worked closely with the Ministry through the consultation and development of this important piece of legislation," said Michael Beard, CEO RECO. "The updated legislation will provide enhanced protection for consumers and provide additional clarity for registrants around their role and responsibilities to both the buyer and seller. These changes are a reflection of the rapidly changing and modern marketplace and will help to ensure that consumers are protected when they make the biggest purchase of their life."

Quick Facts

Background Information

Additional Resources

"Real estate salespersons and brokers are the experts for home buyers and sellers," said Lisa Thompson, Minister of Government and Consumer Services. "Whether a transaction involves a fixer-upper, a move-in ready dream home or a commercial property, every consumer should know that the person they are dealing with is professional, knowledgeable and accountable."

Between January and March 2019, almost 7,000 consumers and real estate professionals responded to an online government survey and consultation paper about potential changes to the act. The Trust in Real Estate Services Act, if passed by the legislature would address the need for a stronger and more ethical business environment, to protect consumers when making their biggest purchase.

For example, the Act would:

- Enable regulatory changes that would give consumers more choice in the purchase and sale process and improve the information they receive about what a real estate professional and brokerage must do for them.

- Improve professionalism among real estate professionals and brokerages by allowing for regulatory changes to enhance ethical requirements.

- Update the Real Estate Council of Ontario (RECO)'s regulatory powers, by allowing it to levy financial penalties (also known as administrative penalties) to encourage compliance with the Act.

- Create a stronger business environment by laying the foundation for allowing real estate professionals to incorporate and be paid through the corporation while maintaining measures that protect consumers.

- Bring legislation up-to-date and reduce regulatory burden.

"The Real Estate Council of Ontario (RECO) is pleased to have worked closely with the Ministry through the consultation and development of this important piece of legislation," said Michael Beard, CEO RECO. "The updated legislation will provide enhanced protection for consumers and provide additional clarity for registrants around their role and responsibilities to both the buyer and seller. These changes are a reflection of the rapidly changing and modern marketplace and will help to ensure that consumers are protected when they make the biggest purchase of their life."

Quick Facts

- According to data from Statistics Canada, the total value of all homes in Ontario more than doubled between 2005 and 2015, increasing to more than $2 trillion. Inflation at the same time was less than 20 per cent.

- There are more than 86,000 registered real estate salespersons, brokers and brokerages in Ontario.

Background Information

Additional Resources

- Statistics Canada residential property values study

- The Real Estate Council of Ontario is the administrative authority that has been delegated responsibility to administer and enforce the act

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Paragraph. 按此處以編輯.

Copyright© 2024, Markham Centre Realty Inc.,Brokerage. All Rights Reserved.

Designed & developed by La

Designed & developed by La