CONDO NEWS

Sidewalk Labs courting local venture capitalists to back smart-city project on Toronto waterfront(2019.10.22)

Google affiliate Sidewalk Labs has been trying to win the support of Canada’s venture-capital community in the months leading up to a crucial deadline for its proposal to develop a high-tech neighbourhood on Toronto’s waterfront.

The New York urban-planning firm co-hosted a dinner for about 15 venture capitalists (VCs) and other investors on the rooftop patio of the Broadview Hotel in Toronto’s east end in July with hopes to sell them on the controversial project. It was co-hosted by the Canadian Venture Capital and Private Equity Association, or CVCA.

Among those in attendance were CVCA chief executive Kim Furlong and chair Peter Dowse; Sidewalk head Dan Doctoroff; Mark Skapinker, managing partner of Brightspark Ventures; Janet Bannister, partner at Real Ventures; and Bruce Croxon, managing partner of Round 13 Capital.

Sidewalk, a subsidiary of Alphabet Inc.., has since been taking meetings with local VCs and startups whose interests might align with the kind of city-centric technology it hopes to implement in its Toronto project, including at the Canadian Innovation Exchange conference in Toronto last week. Sidewalk revealed in its June draft master plan that it wanted to seed $10-million into a venture fund for local, early-stage companies focused on “urban innovation” and is seeking co-investors to grow the fund.

Tripartite development agency Waterfront Toronto awarded Sidewalk the right to plan a 12-acre plot of prime real estate on the shore of Lake Ontario two years ago this month. Since then, the company has said it hopes to implement technology there that could improve urban life, from artificial-intelligence-powered heating and cooling to adaptive pedestrian crossings to underground freight-and-waste-moving systems.

The company has been on a charm offensive for the past two years as the ranks of its detractors grew from a few vocal tech executives and open-data advocates to include politicians from all three levels of government, renowned academics, intellectual-property lawyers and the Canadian Civil Liberties Association.

The Globe and Mail reported last spring that Sidewalk staff had an exclusive dinner last October with many of Ottawa’s top-ranking deputy ministers at the federal Department of Innovation. The company also has regular meetings with a large “advisory panel” of dozens of urbanists, philanthropists and executives, and regularly lobbies all three levels of government.

Critics have long argued that Canadian technology companies should play a role in developing such a “smart city” community on Toronto’s waterfront and Sidewalk has said it will involve Canadian tech. But few specific details have emerged about what that role would look like, even as Sidewalk and Waterfront Toronto negotiate terms of their latest deal ahead of an Oct. 31 deadline.

The project has polarized the country’s tech community, with critics such as BlackBerry pioneer Jim Balsillie arguing that Canadians stand to lose out on massive future revenue opportunities from Sidewalk-developed technologies. Others, such as Clearbanc co-founders Michele Romanow and Andrew D’Souza, have thrown their support behind the project, calling it a catalyst for the tech sector.

That tension extended to tech investors who were invited to the Sidewalk and CVCA’s dinner. Some VCs who were invited decided to stay away because of frustrations about how Sidewalk was addressing concerns from the tech community. The meeting focused on selling the benefits of the Sidewalk project in general, rather than a specific opportunity to co-invest in Sidewalk’s fund. Sources invited to the meeting were granted confidentiality by The Globe, owing to fear of damaging business relationships.

Brightspark VC Mr. Skapinker said that while there were some pointed discussions about Sidewalk’s support for Canadian venture, “it was quite a positive meeting.” Mr. Croxon, who attended only briefly, said he remained concerned about the Sidewalk project’s unanswered questions. Without guarantees around Canadian benefits from the project’s intellectual property, “I am not in favour of blindly going ahead," he said in an interview. (Ms. Bannister declined to comment, but confirmed her attendance.)

Sidewalk’s director of investments is Nicole LeBlanc, who joined from the Business Development Bank of Canada last year. Sidewalk declined to make anyone available for an interview for this story because of its continuing negotiations with Waterfront Toronto. Details of its venture fund are expected to be revealed in the coming weeks, should both Waterfront Toronto and Sidewalk agree to proceed after their Oct. 31 deadline.

The CVCA’s Ms. Furlong said in an interview that Ms. LeBlanc suggested to meet with the venture-capital community after Sidewalk published its draft master plan in June in order to share details. “One of the key pillars of our organization is to connect people for co-investments and deal flow,” Ms. Furlong said. “It was a dinner to network, and for Sidewalk Labs to talk about the plan that had just been released.”

In August, Sidewalk joined forces with the Ontario Teachers’ Pension Plan to launch an infrastructure-investment company that would invest in projects across North America.(The Globe and Mail, Josh O' Kane)

The New York urban-planning firm co-hosted a dinner for about 15 venture capitalists (VCs) and other investors on the rooftop patio of the Broadview Hotel in Toronto’s east end in July with hopes to sell them on the controversial project. It was co-hosted by the Canadian Venture Capital and Private Equity Association, or CVCA.

Among those in attendance were CVCA chief executive Kim Furlong and chair Peter Dowse; Sidewalk head Dan Doctoroff; Mark Skapinker, managing partner of Brightspark Ventures; Janet Bannister, partner at Real Ventures; and Bruce Croxon, managing partner of Round 13 Capital.

Sidewalk, a subsidiary of Alphabet Inc.., has since been taking meetings with local VCs and startups whose interests might align with the kind of city-centric technology it hopes to implement in its Toronto project, including at the Canadian Innovation Exchange conference in Toronto last week. Sidewalk revealed in its June draft master plan that it wanted to seed $10-million into a venture fund for local, early-stage companies focused on “urban innovation” and is seeking co-investors to grow the fund.

Tripartite development agency Waterfront Toronto awarded Sidewalk the right to plan a 12-acre plot of prime real estate on the shore of Lake Ontario two years ago this month. Since then, the company has said it hopes to implement technology there that could improve urban life, from artificial-intelligence-powered heating and cooling to adaptive pedestrian crossings to underground freight-and-waste-moving systems.

The company has been on a charm offensive for the past two years as the ranks of its detractors grew from a few vocal tech executives and open-data advocates to include politicians from all three levels of government, renowned academics, intellectual-property lawyers and the Canadian Civil Liberties Association.

The Globe and Mail reported last spring that Sidewalk staff had an exclusive dinner last October with many of Ottawa’s top-ranking deputy ministers at the federal Department of Innovation. The company also has regular meetings with a large “advisory panel” of dozens of urbanists, philanthropists and executives, and regularly lobbies all three levels of government.

Critics have long argued that Canadian technology companies should play a role in developing such a “smart city” community on Toronto’s waterfront and Sidewalk has said it will involve Canadian tech. But few specific details have emerged about what that role would look like, even as Sidewalk and Waterfront Toronto negotiate terms of their latest deal ahead of an Oct. 31 deadline.

The project has polarized the country’s tech community, with critics such as BlackBerry pioneer Jim Balsillie arguing that Canadians stand to lose out on massive future revenue opportunities from Sidewalk-developed technologies. Others, such as Clearbanc co-founders Michele Romanow and Andrew D’Souza, have thrown their support behind the project, calling it a catalyst for the tech sector.

That tension extended to tech investors who were invited to the Sidewalk and CVCA’s dinner. Some VCs who were invited decided to stay away because of frustrations about how Sidewalk was addressing concerns from the tech community. The meeting focused on selling the benefits of the Sidewalk project in general, rather than a specific opportunity to co-invest in Sidewalk’s fund. Sources invited to the meeting were granted confidentiality by The Globe, owing to fear of damaging business relationships.

Brightspark VC Mr. Skapinker said that while there were some pointed discussions about Sidewalk’s support for Canadian venture, “it was quite a positive meeting.” Mr. Croxon, who attended only briefly, said he remained concerned about the Sidewalk project’s unanswered questions. Without guarantees around Canadian benefits from the project’s intellectual property, “I am not in favour of blindly going ahead," he said in an interview. (Ms. Bannister declined to comment, but confirmed her attendance.)

Sidewalk’s director of investments is Nicole LeBlanc, who joined from the Business Development Bank of Canada last year. Sidewalk declined to make anyone available for an interview for this story because of its continuing negotiations with Waterfront Toronto. Details of its venture fund are expected to be revealed in the coming weeks, should both Waterfront Toronto and Sidewalk agree to proceed after their Oct. 31 deadline.

The CVCA’s Ms. Furlong said in an interview that Ms. LeBlanc suggested to meet with the venture-capital community after Sidewalk published its draft master plan in June in order to share details. “One of the key pillars of our organization is to connect people for co-investments and deal flow,” Ms. Furlong said. “It was a dinner to network, and for Sidewalk Labs to talk about the plan that had just been released.”

In August, Sidewalk joined forces with the Ontario Teachers’ Pension Plan to launch an infrastructure-investment company that would invest in projects across North America.(The Globe and Mail, Josh O' Kane)

Scant supply boosting Toronto condo prices(2019.09.06)

Potential buyers looking for a condo in the Greater Toronto Area will find some properties to look at now that the fall real estate market is gearing up but industry watchers are not expecting a deluge of new listings.

That scant supply is keeping prices lofty and making it difficult for many people to find a unit they want to buy.

Meanwhile, new project launches have slowed to a trickle, says real estate agent Christopher Bibby of ReMax Hallmark Bibby Group Realty Ltd.

“It’s the slowest I’ve ever seen and prices are the highest I’ve ever seen,” he says.

Many developers have switched strategies and are now building towers for the rental market, he says.

“You see cranes but not everything is necessarily being offered for sale. Developers are aware that there’s not going to be as much supply of new units so they can push up prices.”

Investors are still interested in buying pre-construction condos, Mr. Bibby says, but few are interested in a quick flip once the unit is completed. Most are looking ahead to where the market will be in 10 years or 20 years, he says.

“Everyone really has this long-term outlook now.”

Mr. Bibby says the investors he’s talking to are not concerned that purpose-built rentals will eat into demand for condo units down the road.

“They’re more worried that there won’t be anything to buy down the road when their kids finish university.”

In recent years, prices for units that are still under construction or in the planning stage have soared past those at existing buildings. At many projects under development in the core, prices have surpassed $1,000 per square foot.

As a result, many investors are leaning towards buying an existing unit in the resale market, Mr. Bibby says.

“I think people are still seeing value on the resale side.”

Low inventory is keeping prices high in the resale market, he adds.

“In the spring there wasn’t much supply.”

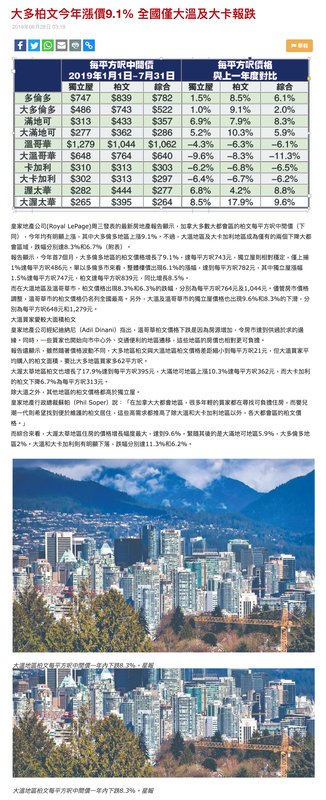

A recent report by Royal LePage found that the median price per square foot of condominiums sold in the Greater Toronto Area has risen 9.1 per cent for the year to July 31 compared with the same period last year. That gain brought the median price-per-square-foot for resale and newly-built units to $743 at the end of July, according to Royal LePage.

By contrast, the price-per-square-foot of a detached house edged up one per cent in the first seven months of the year compared with the same period last year. The median price-per-square-foot of a detached house in the GTA stood at $486 at the end of July, the report says.

“Although detached homes hold more value per square foot, condos are more affordable for first-time buyers in the region, given their smaller living space and higher supply, says real estate agent Tom Storey of Royal LePage Signature Realty.

In the City of Toronto, the median price-per-square-foot for a condo unit jumped to $839 at the end of July for an 8.5 per cent increase from the same time in 2018.

Mr. Storey says young people in the millennial generation are willing to pay more for less space in order to be in their desired neighbourhood.

In the Toronto core, the median size of a condominium was 752 square feet, which was half the living area of the median detached home, which came in at 1,512 square feet.

Royal LePage says expanding outside of the city’s 416 area code to the suburban 905 portion of the GTA only gave buyers a four per cent increase in the median condominium living area of 783 square feet.

That compares with a 32 per cent gain in square footage for the median detached home, which came in at 2,000 square feet in the suburbs.

Mr. Bibby, who specializes in lofts and high-end condos in the core, is rolling out six properties for sale now that the Labour Day Weekend has passed.

One is a two-bedroom, 1,200-square-foot loft in the Merchandise Building, another is a two-bedroom unit in the Distillery District and another has a sunset view at Queen’s Quay.

Mr. Bibby says the quick pace of sales in July and early August is a harbinger that the fall market will be fairly brisk this year, but he cautions that the market’s tempo has been unpredictable in the past few years.

Last year at this time he also saw signs buyers would steam ahead in the fall, only to see them hesitate.

“We couldn’t really predict that the fall market was going to soften the way it did.”

This year, properties are still moving along in the segment under $1-million. Units with two bedrooms and two bathrooms – along with entry-level one-bedrooms – are flying off the shelves in the 416, he says.

Higher-priced units are slower to sell, he says.

“Over $2-million we’re deciding strategy,” he says. “We’re not seeing as many bidding wars.”

This month Mr. Bibby is launching a waterfront penthouse at 80 Palace Pier Court in the Humber Bay area with an asking price around the $2.2-million mark.

To build interest, he has done some “soft” marketing. Agents and potential buyers who have seen the photos and video have been calling to ask when it’s coming out, he says.

National Bank of Canada senior economist Krishen Rangasamy points out that Canada’s economy bounced back sharply in the second quarter as real gross domestic product grew at the fastest pace in two years.

Mr. Rangasamy says the results were much better than the Bank of Canada expected, but he expects the central bank to continue to keep a wary eye on the downside risks posed by the ongoing global trade war.

That scant supply is keeping prices lofty and making it difficult for many people to find a unit they want to buy.

Meanwhile, new project launches have slowed to a trickle, says real estate agent Christopher Bibby of ReMax Hallmark Bibby Group Realty Ltd.

“It’s the slowest I’ve ever seen and prices are the highest I’ve ever seen,” he says.

Many developers have switched strategies and are now building towers for the rental market, he says.

“You see cranes but not everything is necessarily being offered for sale. Developers are aware that there’s not going to be as much supply of new units so they can push up prices.”

Investors are still interested in buying pre-construction condos, Mr. Bibby says, but few are interested in a quick flip once the unit is completed. Most are looking ahead to where the market will be in 10 years or 20 years, he says.

“Everyone really has this long-term outlook now.”

Mr. Bibby says the investors he’s talking to are not concerned that purpose-built rentals will eat into demand for condo units down the road.

“They’re more worried that there won’t be anything to buy down the road when their kids finish university.”

In recent years, prices for units that are still under construction or in the planning stage have soared past those at existing buildings. At many projects under development in the core, prices have surpassed $1,000 per square foot.

As a result, many investors are leaning towards buying an existing unit in the resale market, Mr. Bibby says.

“I think people are still seeing value on the resale side.”

Low inventory is keeping prices high in the resale market, he adds.

“In the spring there wasn’t much supply.”

A recent report by Royal LePage found that the median price per square foot of condominiums sold in the Greater Toronto Area has risen 9.1 per cent for the year to July 31 compared with the same period last year. That gain brought the median price-per-square-foot for resale and newly-built units to $743 at the end of July, according to Royal LePage.

By contrast, the price-per-square-foot of a detached house edged up one per cent in the first seven months of the year compared with the same period last year. The median price-per-square-foot of a detached house in the GTA stood at $486 at the end of July, the report says.

“Although detached homes hold more value per square foot, condos are more affordable for first-time buyers in the region, given their smaller living space and higher supply, says real estate agent Tom Storey of Royal LePage Signature Realty.

In the City of Toronto, the median price-per-square-foot for a condo unit jumped to $839 at the end of July for an 8.5 per cent increase from the same time in 2018.

Mr. Storey says young people in the millennial generation are willing to pay more for less space in order to be in their desired neighbourhood.

In the Toronto core, the median size of a condominium was 752 square feet, which was half the living area of the median detached home, which came in at 1,512 square feet.

Royal LePage says expanding outside of the city’s 416 area code to the suburban 905 portion of the GTA only gave buyers a four per cent increase in the median condominium living area of 783 square feet.

That compares with a 32 per cent gain in square footage for the median detached home, which came in at 2,000 square feet in the suburbs.

Mr. Bibby, who specializes in lofts and high-end condos in the core, is rolling out six properties for sale now that the Labour Day Weekend has passed.

One is a two-bedroom, 1,200-square-foot loft in the Merchandise Building, another is a two-bedroom unit in the Distillery District and another has a sunset view at Queen’s Quay.

Mr. Bibby says the quick pace of sales in July and early August is a harbinger that the fall market will be fairly brisk this year, but he cautions that the market’s tempo has been unpredictable in the past few years.

Last year at this time he also saw signs buyers would steam ahead in the fall, only to see them hesitate.

“We couldn’t really predict that the fall market was going to soften the way it did.”

This year, properties are still moving along in the segment under $1-million. Units with two bedrooms and two bathrooms – along with entry-level one-bedrooms – are flying off the shelves in the 416, he says.

Higher-priced units are slower to sell, he says.

“Over $2-million we’re deciding strategy,” he says. “We’re not seeing as many bidding wars.”

This month Mr. Bibby is launching a waterfront penthouse at 80 Palace Pier Court in the Humber Bay area with an asking price around the $2.2-million mark.

To build interest, he has done some “soft” marketing. Agents and potential buyers who have seen the photos and video have been calling to ask when it’s coming out, he says.

National Bank of Canada senior economist Krishen Rangasamy points out that Canada’s economy bounced back sharply in the second quarter as real gross domestic product grew at the fastest pace in two years.

Mr. Rangasamy says the results were much better than the Bank of Canada expected, but he expects the central bank to continue to keep a wary eye on the downside risks posed by the ongoing global trade war.

Waterfront Toronto issues final offer to Sidewalk Labs: no guaranteed LRT, no expansion beyond Quayside(2019.10.31)

In its final offer to Google sister firm Sidewalk Labs, Waterfront Toronto has rejected many of the company’s proposals for a futuristic downtown neighbourhood known as Quayside, insisting the American tech giant confine its ambitions to a narrow 12-acre slice of land and allow all data collected at the site to be managed by the public.

Details of Waterfront Toronto’s final offer, which were described to the Star by a source with knowledge of the document, were sent to Sidewalk Labs on Monday afternoon. They represent a nearly complete repudiation of the conditions the company has set out for one of the world’s first smart city developments. Sidewalk Labs has until Wednesday evening to come to a deal as its existing agreement with Waterfront Toronto expires on Oct. 31.

Key points in the offer include:

“These discussions continue,” he said.

Sidewalk Labs spokesperson Keerthana Rang said she was unable to comment because negotiations continue.

When Sidewalk Labs released the ambitious Master Innovation and Development Plan (MIDP) in June, its proposal went far beyond the small tract of land at the foot of Parliament Street that the company was invited to bid on to include the adjacent Villiers Island — where Google would house its future Canadian headquarters — as well as more than 100 acres in the wider eastern Port Lands.

Sidewalk Labs’ vision included a demand that the city build a $1.2-billion LRT line to service the area — something it offered to help finance.

The company said it would share revenue with the city from any technology developed on the site. It would also receive “performance payments” if certain benchmarks were met, such as the numbers of jobs created.

A previous proposal, that was described in internal documents revealed by the Star, was to have Sidewalk Labs receive a cut of future development fees and property taxes collected on the waterfront. This didn’t make it into the MIDP.

Waterfront Toronto’s counter-offer is an effort “to throw (parts of) the MIDP out” and “start fresh,” said the source, which the Star agreed to not identify because they were discussing confidential negotiations. It reflects many of the positions stated by Waterfront Toronto chair Steve Diamond in an open letter issued after the MIDP was released in June.

Any deal that includes land beyond Quayside is “premature,” Diamond wrote at the time, and “Waterfront Toronto must first see its goals and objectives achieved at Quayside before deciding whether to work together in other areas.”

Waterfront Toronto’s final offer states that Sidewalk must only develop on Quayside, the source said, and the company will have to bid against other developers in the future for the right to develop anywhere else along the eastern waterfront and Port Lands areas — including Villiers Island.

The offer also pushes back the date to secure a commitment from the three levels of government to build an LRT. Instead of insisting that commitment come immediately, the offer would give both sides until December 2020 to lobby government for the public transit line.

It also asks for new provisions for the sharing of intellectual property, which are considerably more favourable to Canadian companies, the source said. Members of the Canadian tech community have criticized the MIDP for maintaining too many of the rights — and future profits derived from these rights — to the technology developed in the smart neighbourhood.

Finally, the source described how Waterfront Toronto wants the data collected at Quayside to be managed. Rather than an independent third party called an urban data trust, as Sidewalk had proposed, all data should be controlled by the government, like it is in Amsterdam and Barcelona, European cities that have enshrined “data sovereignty,” ensuring that citizens, rather than big tech, get to control the way their data and the data collected in public spaces is used.

“The idea is that there’s minimal data collection and maximum distribution,” said the source. “It’s like a library” that would allow any member of the public to use the data collected.

If Sidewalk Labs accepts the offer, and the Waterfront Toronto board approves it, the MIDP will still need to be evaluated and approved before March 31, 2020.(Toronto Star, Marco Chown Oved)

Details of Waterfront Toronto’s final offer, which were described to the Star by a source with knowledge of the document, were sent to Sidewalk Labs on Monday afternoon. They represent a nearly complete repudiation of the conditions the company has set out for one of the world’s first smart city developments. Sidewalk Labs has until Wednesday evening to come to a deal as its existing agreement with Waterfront Toronto expires on Oct. 31.

Key points in the offer include:

- No immediate guarantee the city will build light rail transit.

- A geographic limit to developing the 12-acre Quayside plot.

- A public data governance structure that allows a public body to determine what data is collected and who gets access to it.

- Improved guarantees that technology developed at Quayside will be shared widely.

“These discussions continue,” he said.

Sidewalk Labs spokesperson Keerthana Rang said she was unable to comment because negotiations continue.

When Sidewalk Labs released the ambitious Master Innovation and Development Plan (MIDP) in June, its proposal went far beyond the small tract of land at the foot of Parliament Street that the company was invited to bid on to include the adjacent Villiers Island — where Google would house its future Canadian headquarters — as well as more than 100 acres in the wider eastern Port Lands.

Sidewalk Labs’ vision included a demand that the city build a $1.2-billion LRT line to service the area — something it offered to help finance.

The company said it would share revenue with the city from any technology developed on the site. It would also receive “performance payments” if certain benchmarks were met, such as the numbers of jobs created.

A previous proposal, that was described in internal documents revealed by the Star, was to have Sidewalk Labs receive a cut of future development fees and property taxes collected on the waterfront. This didn’t make it into the MIDP.

Waterfront Toronto’s counter-offer is an effort “to throw (parts of) the MIDP out” and “start fresh,” said the source, which the Star agreed to not identify because they were discussing confidential negotiations. It reflects many of the positions stated by Waterfront Toronto chair Steve Diamond in an open letter issued after the MIDP was released in June.

Any deal that includes land beyond Quayside is “premature,” Diamond wrote at the time, and “Waterfront Toronto must first see its goals and objectives achieved at Quayside before deciding whether to work together in other areas.”

Waterfront Toronto’s final offer states that Sidewalk must only develop on Quayside, the source said, and the company will have to bid against other developers in the future for the right to develop anywhere else along the eastern waterfront and Port Lands areas — including Villiers Island.

The offer also pushes back the date to secure a commitment from the three levels of government to build an LRT. Instead of insisting that commitment come immediately, the offer would give both sides until December 2020 to lobby government for the public transit line.

It also asks for new provisions for the sharing of intellectual property, which are considerably more favourable to Canadian companies, the source said. Members of the Canadian tech community have criticized the MIDP for maintaining too many of the rights — and future profits derived from these rights — to the technology developed in the smart neighbourhood.

Finally, the source described how Waterfront Toronto wants the data collected at Quayside to be managed. Rather than an independent third party called an urban data trust, as Sidewalk had proposed, all data should be controlled by the government, like it is in Amsterdam and Barcelona, European cities that have enshrined “data sovereignty,” ensuring that citizens, rather than big tech, get to control the way their data and the data collected in public spaces is used.

“The idea is that there’s minimal data collection and maximum distribution,” said the source. “It’s like a library” that would allow any member of the public to use the data collected.

If Sidewalk Labs accepts the offer, and the Waterfront Toronto board approves it, the MIDP will still need to be evaluated and approved before March 31, 2020.(Toronto Star, Marco Chown Oved)

Sidewalk Labs agrees to smaller version of proposed project(2019.10.31)

Sidewalk Labs has agreed to a smaller-scale version of the ambitious high-tech waterfront community it proposed for Toronto in June, according to a senior Ontario government source, setting the scene for a crucial vote Thursday morning by the board of Waterfront Toronto.

After months of negotiations with the Google sister company, the waterfront agency sent a letter to Sidewalk Labs on Monday outlining the final terms to proceed with the project, a source close to the discussions said. The Globe and Mail is keeping these sources’ identities confidential because they were not authorized to speak on the matter.

A spokesperson for Sidewalk Labs said they were unable to confirm that it had agreed to the terms of the letter.

The Globe first reported Tuesday that negotiations had come to focus on the 12-acre site that Sidewalk was first granted the right to plan in 2017, rather than the 190-acre site it asked for rights to in June. The terms that Waterfront’s board intends to vote on Thursday also include strong guarantees for the privacy of those in that community, and allow a greater ability for Canadian entities to profit from its innovations.

Two sources close to the negotiations said the letter also said Sidewalk would get no guarantees from governments that long-delayed light rail in the eastern waterfront area would move forward more quickly – an issue that Sidewalk has long said is an incentive for the company to go ahead with the project.

An agreement between both parties Thursday would not put shovels in the ground, but rather give Waterfront the opportunity to further scrutinize the finer details of Sidewalk’s proposals. A final vote would be expected in March, 2020. But in August, the parties agreed to amend their most recent partnership agreement so that it would expire at the end of Thursday if they did not come to a consensus on details such as the project’s scale.

Monday’s letter laid out Waterfront’s final expectations for the Sidewalk partnership, reflecting the frustrations the agency’s chair, Stephen Diamond, has expressed about Sidewalk’s June demands. That month, when Sidewalk published its draft master plan, Mr. Diamond called those demands “aggressive." The company had asked for the right to deploy technology and help plan a site 16 times the size of the property it had original won a contract to plan.

The June draft plan also asked governments to expand public transit, pay performance bonuses to Sidewalk and revise both municipal and provincial laws.

Sidewalk was first announced as the partner to develop the 12-acre “Quayside” site at the foot of Toronto’s Parliament Street in October, 2017. It wanted to build a community “from the internet up,” deploying new technologies and sensors across the neighbourhood – sensors that, in turn, could determine patterns of city life that would beget even newer urban innovations.

Criticisms of the project, however, quickly built up as people began studying the privacy and profit implications of this kind of urban planning.

Ann Cavoukian, the former Ontario privacy commissioner whose framework for data protection is recognized as a global standard, quit a paid advisory position with Sidewalk Labs a year ago after the company couldn’t give her assurances the whole community would adhere to that framework. Intellectual property lawyers and experts, meanwhile, worried that the original proposal might not have given Canadians a fair share of profits from innovation in the community.

Those concerns only increased in June when Sidewalk published the draft master plan. A group of IP experts told The Globe in June that the proposal – which said Sidewalk would share 10 per cent of the profit from some technologies developed, tested or piloted there with governments for a 10-year period, with further terms to be negotiated – was unfair to Canadians.

The much broader scope of the June draft plan also raised the ire of politicians such as City Councillor Joe Cressy, a Waterfront Toronto board member. “When it comes to the broader Port Lands, those lands are not up for sale,” Mr. Cressy said then of the largely city-owned land.(The Globe and Mail, Josh O' Kane )

After months of negotiations with the Google sister company, the waterfront agency sent a letter to Sidewalk Labs on Monday outlining the final terms to proceed with the project, a source close to the discussions said. The Globe and Mail is keeping these sources’ identities confidential because they were not authorized to speak on the matter.

A spokesperson for Sidewalk Labs said they were unable to confirm that it had agreed to the terms of the letter.

The Globe first reported Tuesday that negotiations had come to focus on the 12-acre site that Sidewalk was first granted the right to plan in 2017, rather than the 190-acre site it asked for rights to in June. The terms that Waterfront’s board intends to vote on Thursday also include strong guarantees for the privacy of those in that community, and allow a greater ability for Canadian entities to profit from its innovations.

Two sources close to the negotiations said the letter also said Sidewalk would get no guarantees from governments that long-delayed light rail in the eastern waterfront area would move forward more quickly – an issue that Sidewalk has long said is an incentive for the company to go ahead with the project.

An agreement between both parties Thursday would not put shovels in the ground, but rather give Waterfront the opportunity to further scrutinize the finer details of Sidewalk’s proposals. A final vote would be expected in March, 2020. But in August, the parties agreed to amend their most recent partnership agreement so that it would expire at the end of Thursday if they did not come to a consensus on details such as the project’s scale.

Monday’s letter laid out Waterfront’s final expectations for the Sidewalk partnership, reflecting the frustrations the agency’s chair, Stephen Diamond, has expressed about Sidewalk’s June demands. That month, when Sidewalk published its draft master plan, Mr. Diamond called those demands “aggressive." The company had asked for the right to deploy technology and help plan a site 16 times the size of the property it had original won a contract to plan.

The June draft plan also asked governments to expand public transit, pay performance bonuses to Sidewalk and revise both municipal and provincial laws.

Sidewalk was first announced as the partner to develop the 12-acre “Quayside” site at the foot of Toronto’s Parliament Street in October, 2017. It wanted to build a community “from the internet up,” deploying new technologies and sensors across the neighbourhood – sensors that, in turn, could determine patterns of city life that would beget even newer urban innovations.

Criticisms of the project, however, quickly built up as people began studying the privacy and profit implications of this kind of urban planning.

Ann Cavoukian, the former Ontario privacy commissioner whose framework for data protection is recognized as a global standard, quit a paid advisory position with Sidewalk Labs a year ago after the company couldn’t give her assurances the whole community would adhere to that framework. Intellectual property lawyers and experts, meanwhile, worried that the original proposal might not have given Canadians a fair share of profits from innovation in the community.

Those concerns only increased in June when Sidewalk published the draft master plan. A group of IP experts told The Globe in June that the proposal – which said Sidewalk would share 10 per cent of the profit from some technologies developed, tested or piloted there with governments for a 10-year period, with further terms to be negotiated – was unfair to Canadians.

The much broader scope of the June draft plan also raised the ire of politicians such as City Councillor Joe Cressy, a Waterfront Toronto board member. “When it comes to the broader Port Lands, those lands are not up for sale,” Mr. Cressy said then of the largely city-owned land.(The Globe and Mail, Josh O' Kane )

Sidewalk Labs, Waterfront Toronto move closer to agreement on Quayside project(2019.10.29)

Sidewalk Labs and Waterfront Toronto are getting closer to an agreement to go ahead with a high-tech community on valuable lakefront property at a much smaller scale than the Google sister company asked for in June.

The discussions are focused on a development that is similar in size to the one Waterfront Toronto first envisioned, set on a 12-acre site at the foot of Parliament Street, according to four sources familiar with the situation. The sources were granted confidentiality because they were not authorized to speak publicly about the negotiations.

Two of the sources said the negotiations are moving toward an agreement containing terms that include strong guarantees for the privacy of those in that community, and allow a greater ability for Canadian entities to profit from its innovations.

The board of Waterfront Toronto, an agency of all three levels of government that is charged with reimagining the city’s slice of Lake Ontario shoreline, is expected to vote Thursday morning on the plan. Sidewalk, however, still could walk away from the project.

Waterfront first awarded Sidewalk the right to plan the site, called Quayside, two years ago. The Alphabet Inc. subsidiary positioned its proposal as a world-leading digital-first community, laced with new technologies and sensors to learn about city living to spur further innovation.

When Sidewalk finally published its draft master plan for the project in June, however, it instead asked to help plan and implement technology at a site 16 times that size. Intellectual-property experts said its proposals to monetize the community’s innovations left Canadian companies and taxpayers with too little opportunity to take advantage. A number of critics and politicians balked at the plan.

Waterfront chair Stephen Diamond said he was concerned with its “aggressive” scope, but Sidewalk CEO Dan Doctoroff said that going smaller would make the project less appealing.

Mr. Diamond later set an Oct. 31 deadline for the parties either to align on the project’s scope, and on other details, or to kill it altogether. If the project proceeds past that deadline, Waterfront will continue studying the fine points of Sidewalk’s proposal before a final vote to proceed in early 2020. The project would then require approvals from all three levels of government.

Waterfront declined to confirm the state of negotiations. “We have pushed for a realignment on these critical issues in order to be able to proceed to an evaluation of the Quayside proposal with the confidence that the public interest was protected,” spokesperson Andrew Tumilty said in an e-mail.

Sidewalk did not immediately respond to requests for comment.

The project’s transparency has long been a matter of contention. Prime Minister Justin Trudeau said at its October, 2017, announcement that he and then-Alphabet executive chairman Eric Schmidt “have been talking about collaborating on this for a few years now,” despite the fact that Waterfront had said the contract was won through a fair request-for-proposals process. Earlier this week, more than 100 local leaders and residents signed a letter, spearheaded by the #BlockSidewalk opposition group, calling for more transparency during the negotiations.

Sidewalk marketed its Quayside plans as a community built “from the internet up,” with new technologies to make city living easier, such as adaptive pedestrian crossings and underground freight transport, as well as sensors to learn about urban life to seed future innovations.

Proponents of the project, such as the Toronto Region Board of Trade, have touted Sidewalk’s vision as a chance to make the city a world-class innovator. However, early criticisms of the privacy implications of such a community eventually ballooned into concerns about how much Canadians would benefit from the innovations there, including from the mountain of products that could be sold and patents that could be licensed worldwide.

After Ontario’s Auditor-General Bonnie Lysyk raised concerns last December about the process, the ranks of critics grew to include politicians from all three levels of government, Canadian tech titans, open-data activists and prominent academics. In the meantime, more than half a dozen leaders and advisers from both organizations have resigned or been fired in connection with the project.

Sidewalk said in its initial proposal that it would need more than 12 acres to deploy technologies on a scale that made sense to properly test them. But in its draft master plan, it asked for the right to do significantly more than Waterfront Toronto could deliver. The 190-acre proposal would have required governments to expand public transit, pay performance bonuses to Sidewalk and revise both municipal and provincial laws.

The project has come under more scrutiny since then, including from the Ontario Privacy Commissioner Brian Beamish, who criticized Sidewalk’s proposed model for storing data, and Waterfront Toronto’s own panel of digital-strategy advisers, who called their technology proposals abstract.(The Globe and Mail, Josh O' Kane)

The discussions are focused on a development that is similar in size to the one Waterfront Toronto first envisioned, set on a 12-acre site at the foot of Parliament Street, according to four sources familiar with the situation. The sources were granted confidentiality because they were not authorized to speak publicly about the negotiations.

Two of the sources said the negotiations are moving toward an agreement containing terms that include strong guarantees for the privacy of those in that community, and allow a greater ability for Canadian entities to profit from its innovations.

The board of Waterfront Toronto, an agency of all three levels of government that is charged with reimagining the city’s slice of Lake Ontario shoreline, is expected to vote Thursday morning on the plan. Sidewalk, however, still could walk away from the project.

Waterfront first awarded Sidewalk the right to plan the site, called Quayside, two years ago. The Alphabet Inc. subsidiary positioned its proposal as a world-leading digital-first community, laced with new technologies and sensors to learn about city living to spur further innovation.

When Sidewalk finally published its draft master plan for the project in June, however, it instead asked to help plan and implement technology at a site 16 times that size. Intellectual-property experts said its proposals to monetize the community’s innovations left Canadian companies and taxpayers with too little opportunity to take advantage. A number of critics and politicians balked at the plan.

Waterfront chair Stephen Diamond said he was concerned with its “aggressive” scope, but Sidewalk CEO Dan Doctoroff said that going smaller would make the project less appealing.

Mr. Diamond later set an Oct. 31 deadline for the parties either to align on the project’s scope, and on other details, or to kill it altogether. If the project proceeds past that deadline, Waterfront will continue studying the fine points of Sidewalk’s proposal before a final vote to proceed in early 2020. The project would then require approvals from all three levels of government.

Waterfront declined to confirm the state of negotiations. “We have pushed for a realignment on these critical issues in order to be able to proceed to an evaluation of the Quayside proposal with the confidence that the public interest was protected,” spokesperson Andrew Tumilty said in an e-mail.

Sidewalk did not immediately respond to requests for comment.

The project’s transparency has long been a matter of contention. Prime Minister Justin Trudeau said at its October, 2017, announcement that he and then-Alphabet executive chairman Eric Schmidt “have been talking about collaborating on this for a few years now,” despite the fact that Waterfront had said the contract was won through a fair request-for-proposals process. Earlier this week, more than 100 local leaders and residents signed a letter, spearheaded by the #BlockSidewalk opposition group, calling for more transparency during the negotiations.

Sidewalk marketed its Quayside plans as a community built “from the internet up,” with new technologies to make city living easier, such as adaptive pedestrian crossings and underground freight transport, as well as sensors to learn about urban life to seed future innovations.

Proponents of the project, such as the Toronto Region Board of Trade, have touted Sidewalk’s vision as a chance to make the city a world-class innovator. However, early criticisms of the privacy implications of such a community eventually ballooned into concerns about how much Canadians would benefit from the innovations there, including from the mountain of products that could be sold and patents that could be licensed worldwide.

After Ontario’s Auditor-General Bonnie Lysyk raised concerns last December about the process, the ranks of critics grew to include politicians from all three levels of government, Canadian tech titans, open-data activists and prominent academics. In the meantime, more than half a dozen leaders and advisers from both organizations have resigned or been fired in connection with the project.

Sidewalk said in its initial proposal that it would need more than 12 acres to deploy technologies on a scale that made sense to properly test them. But in its draft master plan, it asked for the right to do significantly more than Waterfront Toronto could deliver. The 190-acre proposal would have required governments to expand public transit, pay performance bonuses to Sidewalk and revise both municipal and provincial laws.

The project has come under more scrutiny since then, including from the Ontario Privacy Commissioner Brian Beamish, who criticized Sidewalk’s proposed model for storing data, and Waterfront Toronto’s own panel of digital-strategy advisers, who called their technology proposals abstract.(The Globe and Mail, Josh O' Kane)

Ontario regulator favours builders over homeowners, auditor says(2019.10.30)

Ontario’s Auditor-General has issued a scathing report on the inner workings of the province’s home-building industry regulator, Tarion Warranty Corp., urging changes that target everything from high-priced salaries, too-cozy relationships with home builders and confusing rules that allowed it to reject thousands of legitimate claims from homeowners.

Tarion’s role in the new home construction industry is both to regulate builders and to offer insurance payments to home buyers when builders do not repair defects that meet warranty requirements. Because builders provide those warranties, the report goes so far as to suggest Tarion remove the word “warranty” from the corporation’s name, to clarify its role to consumers.

Auditor-General Bonnie Lysyk was invited to review the agency in 2018 by Queen’s Park’s standing committee on public accounts. The Progressive Conservative government and the current Tarion leadership say they accept all 32 recommendations in the audit and are pledging to implement them.

The report’s top-line recommendation urges more distance between Tarion and the Ontario Home Builders’ Association. Ms. Lysyk concludes the “relationship between the Tarion Board and the OHBA created an imbalance over the years that favoured the interests of builders at the expense of homebuyers.”

The auditor took issue with Tarion policies that required it to give the OHBA advance notice of any new regulations and that gave the builder’s lobby eight of the 16 seats on the board of directors. Tarion had also paid $185,000 over five years to sponsor a leadership dinner at the industry’s annual conference.

Joe Vaccaro, CEO of the OHBA, agrees that his organization has tight ties with Tarion. “I can appreciate the word ‘imbalance’ because we are so active in the advocacy space.” But he acknowledged in a later e-mail that the imbalance may have cost consumers. “Yes, it probably has happened where the system has failed to resolve legitimate home buyer issues and left them out of pocket.”

Former Tarion board chair Chris Spiteri said the optics “are horrible.” He criticized Tarion’s participation in golf tournaments and award ceremonies with OHBA. “These are the guys we’re supposed to be regulating.”

The report says Tarion’s “processes and practices do not always conform to the spirit or intent of the Ontario New Home Warranties Plan Act.” For example, homeowners must first contact their builder regarding any defects, and it is the builder who provides the actual warranty for the home (despite what Tarion’s name suggests). If a builder fails to resolve the complaint, homeowners can appeal to Tarion for a remedy.

Since 2003, Tarion has imposed two deadlines for contacting the agency: 30 days after taking possession of a new home, and then a second 30-day window one year later. “Between 2014 and 2018, Tarion refused assistance on about 9,700 requests because the homeowners had missed the 30-day deadlines. About 1,300 of these requests had missed the deadline by a single day,” the report says. A sampling of the rejected claims included such major issues as cracked foundations, building-code violations and lack of proper insulation.

While the Auditor-General found Tarion can be strict with home buyers, the report concludes it can be too lenient with builders, going so far as to collect less money from builders, underfunding its own operations. Tarion’s main funding comes from security deposits from builders, but the Auditor-General found the deposits are often assessed at below market value while payouts to home buyers are based on current values. "As a result, [Tarion] paid out about $127-million from the Guarantee Fund over the last 10 years, and recovered from builders only about 30 per cent of the pay-outs.”

In multiple cases, builders that failed to honour warranties were able to renew their licence to build new homes. “Tarion told us that it would be unfair to use its licensing power to force collection payments from builders,” the report says.

In 2018, Tarion received 70,000 requests for help from home buyers, and eventually paid out $17.4-million in about 800 cases.

Tarion’s online builder directory is also missing many examples of data buyers might be interested in. Between 2009 and 2018, it convicted 666 individuals of illegal building, but those convictions were never recorded in the builder directory.

“The Builder Directory should be administered by government, not by industry-dominated or secretive agencies like Tarion. There needs to be transparency on builder track records to properly inform the public,” said Barbara Captijn, a consumer advocate and long-time critic of Tarion. “Consumers have been muzzled for over a decade for saying this is a rogue corporation with no credible oversight, or accountability to the public.”

The report also raises concerns about bonuses and salaries at the not-for-profit company, noting that five of 11 performance indicators that contribute to bonus payments relate to maximizing profits and keeping expenses low. “These incentives might be better suited to a profit-making insurance company than a not-for-profit delegated authority with the mandate to help new home buyers,” the report says. Senior leadership, vice-presidents and above could earn 30 per cent to 60 per cent of their annual salaries in bonuses; $2-million in bonuses were paid out in 2018.

Tarion is a delegated authority; its employees are not government workers, so salaries do not appear in Ontario’s annual Sunshine List. On Oct. 15, Tarion revealed its compensation to top leadership for the first time in 41 years: Howard Bogach, president and CEO of Tarion, collected $681,616 in salary and bonuses in 2018, and together the 11 senior leaders collected $4.04-million in total compensation.

"We thank the Auditor-General for her recommendations and look forward to acting on them with the best interests of homeowners in mind,” Mr. Bogach said in a written statement.(The Globe and Mail, Shane Dingman)

Tarion’s role in the new home construction industry is both to regulate builders and to offer insurance payments to home buyers when builders do not repair defects that meet warranty requirements. Because builders provide those warranties, the report goes so far as to suggest Tarion remove the word “warranty” from the corporation’s name, to clarify its role to consumers.

Auditor-General Bonnie Lysyk was invited to review the agency in 2018 by Queen’s Park’s standing committee on public accounts. The Progressive Conservative government and the current Tarion leadership say they accept all 32 recommendations in the audit and are pledging to implement them.

The report’s top-line recommendation urges more distance between Tarion and the Ontario Home Builders’ Association. Ms. Lysyk concludes the “relationship between the Tarion Board and the OHBA created an imbalance over the years that favoured the interests of builders at the expense of homebuyers.”

The auditor took issue with Tarion policies that required it to give the OHBA advance notice of any new regulations and that gave the builder’s lobby eight of the 16 seats on the board of directors. Tarion had also paid $185,000 over five years to sponsor a leadership dinner at the industry’s annual conference.

Joe Vaccaro, CEO of the OHBA, agrees that his organization has tight ties with Tarion. “I can appreciate the word ‘imbalance’ because we are so active in the advocacy space.” But he acknowledged in a later e-mail that the imbalance may have cost consumers. “Yes, it probably has happened where the system has failed to resolve legitimate home buyer issues and left them out of pocket.”

Former Tarion board chair Chris Spiteri said the optics “are horrible.” He criticized Tarion’s participation in golf tournaments and award ceremonies with OHBA. “These are the guys we’re supposed to be regulating.”

The report says Tarion’s “processes and practices do not always conform to the spirit or intent of the Ontario New Home Warranties Plan Act.” For example, homeowners must first contact their builder regarding any defects, and it is the builder who provides the actual warranty for the home (despite what Tarion’s name suggests). If a builder fails to resolve the complaint, homeowners can appeal to Tarion for a remedy.

Since 2003, Tarion has imposed two deadlines for contacting the agency: 30 days after taking possession of a new home, and then a second 30-day window one year later. “Between 2014 and 2018, Tarion refused assistance on about 9,700 requests because the homeowners had missed the 30-day deadlines. About 1,300 of these requests had missed the deadline by a single day,” the report says. A sampling of the rejected claims included such major issues as cracked foundations, building-code violations and lack of proper insulation.

While the Auditor-General found Tarion can be strict with home buyers, the report concludes it can be too lenient with builders, going so far as to collect less money from builders, underfunding its own operations. Tarion’s main funding comes from security deposits from builders, but the Auditor-General found the deposits are often assessed at below market value while payouts to home buyers are based on current values. "As a result, [Tarion] paid out about $127-million from the Guarantee Fund over the last 10 years, and recovered from builders only about 30 per cent of the pay-outs.”

In multiple cases, builders that failed to honour warranties were able to renew their licence to build new homes. “Tarion told us that it would be unfair to use its licensing power to force collection payments from builders,” the report says.

In 2018, Tarion received 70,000 requests for help from home buyers, and eventually paid out $17.4-million in about 800 cases.

Tarion’s online builder directory is also missing many examples of data buyers might be interested in. Between 2009 and 2018, it convicted 666 individuals of illegal building, but those convictions were never recorded in the builder directory.

“The Builder Directory should be administered by government, not by industry-dominated or secretive agencies like Tarion. There needs to be transparency on builder track records to properly inform the public,” said Barbara Captijn, a consumer advocate and long-time critic of Tarion. “Consumers have been muzzled for over a decade for saying this is a rogue corporation with no credible oversight, or accountability to the public.”

The report also raises concerns about bonuses and salaries at the not-for-profit company, noting that five of 11 performance indicators that contribute to bonus payments relate to maximizing profits and keeping expenses low. “These incentives might be better suited to a profit-making insurance company than a not-for-profit delegated authority with the mandate to help new home buyers,” the report says. Senior leadership, vice-presidents and above could earn 30 per cent to 60 per cent of their annual salaries in bonuses; $2-million in bonuses were paid out in 2018.

Tarion is a delegated authority; its employees are not government workers, so salaries do not appear in Ontario’s annual Sunshine List. On Oct. 15, Tarion revealed its compensation to top leadership for the first time in 41 years: Howard Bogach, president and CEO of Tarion, collected $681,616 in salary and bonuses in 2018, and together the 11 senior leaders collected $4.04-million in total compensation.

"We thank the Auditor-General for her recommendations and look forward to acting on them with the best interests of homeowners in mind,” Mr. Bogach said in a written statement.(The Globe and Mail, Shane Dingman)

Auditor slams home-building regulator(2019.10.31)

Ontario’s auditor general has released a scathing report accusing the province’s home-building regulator and warranty provider of failing tens of thousands of new homebuyers by putting the interests of builders ahead of consumer protection.

Auditor general Bonnie Lysyk found the processes of Tarion Warranty Corp. were confusing and costly to homebuyers, and that the corporation failed to flag and sanction bad builders.

Lysyk also raised issue with how the not-for-profit organization compensated its senior management, by giving bonuses based on the agency’s profits.

In a special Tarion audit released Wednesday, Lysyk issued 32 recommendations to fix the agency’s “restrictive processes,” ranging from improvements to its customer call centre, to beefed up measures to deter the cancellation of pre-construction condos. There have been 460 developments cancelled in the last decade, according to the auditor.

“There’s been a lot of rules and regulations that favour the builder and the lack of government oversight has probably perpetuated those problems,” Lysyk said.

Calling for a builder code of conduct, she said Tarion had failed to rigorously ensure homebuilders “operated ethically and with integrity.”

“Some builders had their licences renewed even after they demonstrated problematic behaviour and, in some cases, failed to reimburse Tarion for costs incurred to resolve defects,” she said.

The report found that in 65 per cent of cases between 2014 and 2018, builders failed to fix problems that should have been covered by the warranty.

Ahomeowners’ group says Tarion is beyond repair.

“We know large numbers of Ontario’s new homeowners are suffering in newly built homes that don’t even meet the minimum Ontario building code standards,” said Karen Somerville of Canadians for Properly Built Homes (CPBH).

She co-founded the group in 2004 after she and her husband moved into an Ottawa home found to have 130 defects.

“We’re moving into winter. People need heat. We are already getting reports from homeowners who have been told by their own specialists that their homes don’t meet the Ontario building code, but their claims were denied by Tarion. They need help now,” Somerville said.

The Ontario government does not fund Tarion. Its revenue comes from the licensing fees of 5,600 builders and the registration fees they pay on about 60,000 new homes a year. At the end of last year about 380,000 homes were still covered by Tarion warranties.

If a builder doesn’t fix a defect, Tarion provides compensation and then tries to recoup the costs from the builder. The process to compensate homeowners or fix the defect is supposed to take up to180 days. But Lysyk found it frequently took 18 months.

Last year, Tarion received 70,000 requests for assistance from homeowners. Most were resolved directly with the builder but Tarion intervened in about 1,600 cases and, in the end, paid out $17.4 million in compensation or repairs on about 800 homes.

Warranties cover between one and seven years of labour, materials and building code violations depending on the component of the home. Plumbing and electrical systems, for example, are covered for two years. Major structural defects that impair the owner’s use of their home can be covered for up to seven years.

Tarion’s call centre receives about 90,000 calls a year, handled by nine staff. The audit showed that in about14 per cent of cases in a sample this year, 14 per cent of callers received an inaccurate or unhelpful answer.

The audit showed 9,700 consumers were denied Tarion assistance between 2014 and 2018 simply because they failed to submit a form within two 30day periods allowed by Tarion — the first 30 days and the last 30 days in the year after they took occupancy of their new home. Tarion gives the builder 120 days to fix the problem. If the problem isn’t resolved it’s up to the homeowner to make Tarion aware.

Lysyk said the 30-day windows should be eliminated because they are preventing many people from receiving help.

Minister of Government and Consumer Services Lisa Thompson said she will ensure the auditor’s recommendations are addressed. The Progressive Conservative government has already required Tarion to post board and executive compensation and raise public awareness of the risks of buying a pre-construction condo, she said. It will announce by the end of the year how Tarion will be restructured and whether the province will look at a multi-provider system for new home warranties — something other provinces use.

The only avenues of appeal for a Tarion decision are through the courts or the Licence Appeal Tribunal (LAT). CPBH found that 85 per cent of consumers lost their appeal at the LAT. “Many people have given up because people can see you can’t win there,” said Somerville.

Lysyk was also critical of Tarion’s senior management reward system that paid out 30 to 60 per cent of executives’ annual salaries in bonuses based on the agency’s profits, which were achieved by minimizing payments to consumers. The approach would be more appropriately taken by the private sector than a government-delegated, not-for-profit corporation, Lysyk said.

Tarion said it accepts all the auditor’s recommendations. It said it has already enhanced disclosure for buyers of preconstruction condos and updated its builder directory. Its executives earned more than $4 million last year, including $769,410 for CEO Howard Bogach. Its directors — many of whom work directly for the building industry — collectively earned more than $500,000 last year.

Opposition MPPs called for tougher penalties for builders and improved consumer protections.

“The entire culture and makeup of Tarion should be consumer protection first and not simply to support the desires of developers and builders, which has been happening for years and years,” said NDP Government Services and Consumer Protection critic Tom Rakocevic (Humber River-Black Creek).

The public interest has to go before “what appears to be a profit-driven incentive structure for senior executives,” said Green party MPP Mike Schreiner.(Toronto Star, Tess Kalinowski)

Auditor general Bonnie Lysyk found the processes of Tarion Warranty Corp. were confusing and costly to homebuyers, and that the corporation failed to flag and sanction bad builders.

Lysyk also raised issue with how the not-for-profit organization compensated its senior management, by giving bonuses based on the agency’s profits.

In a special Tarion audit released Wednesday, Lysyk issued 32 recommendations to fix the agency’s “restrictive processes,” ranging from improvements to its customer call centre, to beefed up measures to deter the cancellation of pre-construction condos. There have been 460 developments cancelled in the last decade, according to the auditor.

“There’s been a lot of rules and regulations that favour the builder and the lack of government oversight has probably perpetuated those problems,” Lysyk said.

Calling for a builder code of conduct, she said Tarion had failed to rigorously ensure homebuilders “operated ethically and with integrity.”

“Some builders had their licences renewed even after they demonstrated problematic behaviour and, in some cases, failed to reimburse Tarion for costs incurred to resolve defects,” she said.

The report found that in 65 per cent of cases between 2014 and 2018, builders failed to fix problems that should have been covered by the warranty.

Ahomeowners’ group says Tarion is beyond repair.

“We know large numbers of Ontario’s new homeowners are suffering in newly built homes that don’t even meet the minimum Ontario building code standards,” said Karen Somerville of Canadians for Properly Built Homes (CPBH).

She co-founded the group in 2004 after she and her husband moved into an Ottawa home found to have 130 defects.

“We’re moving into winter. People need heat. We are already getting reports from homeowners who have been told by their own specialists that their homes don’t meet the Ontario building code, but their claims were denied by Tarion. They need help now,” Somerville said.

The Ontario government does not fund Tarion. Its revenue comes from the licensing fees of 5,600 builders and the registration fees they pay on about 60,000 new homes a year. At the end of last year about 380,000 homes were still covered by Tarion warranties.

If a builder doesn’t fix a defect, Tarion provides compensation and then tries to recoup the costs from the builder. The process to compensate homeowners or fix the defect is supposed to take up to180 days. But Lysyk found it frequently took 18 months.

Last year, Tarion received 70,000 requests for assistance from homeowners. Most were resolved directly with the builder but Tarion intervened in about 1,600 cases and, in the end, paid out $17.4 million in compensation or repairs on about 800 homes.

Warranties cover between one and seven years of labour, materials and building code violations depending on the component of the home. Plumbing and electrical systems, for example, are covered for two years. Major structural defects that impair the owner’s use of their home can be covered for up to seven years.

Tarion’s call centre receives about 90,000 calls a year, handled by nine staff. The audit showed that in about14 per cent of cases in a sample this year, 14 per cent of callers received an inaccurate or unhelpful answer.

The audit showed 9,700 consumers were denied Tarion assistance between 2014 and 2018 simply because they failed to submit a form within two 30day periods allowed by Tarion — the first 30 days and the last 30 days in the year after they took occupancy of their new home. Tarion gives the builder 120 days to fix the problem. If the problem isn’t resolved it’s up to the homeowner to make Tarion aware.

Lysyk said the 30-day windows should be eliminated because they are preventing many people from receiving help.

Minister of Government and Consumer Services Lisa Thompson said she will ensure the auditor’s recommendations are addressed. The Progressive Conservative government has already required Tarion to post board and executive compensation and raise public awareness of the risks of buying a pre-construction condo, she said. It will announce by the end of the year how Tarion will be restructured and whether the province will look at a multi-provider system for new home warranties — something other provinces use.

The only avenues of appeal for a Tarion decision are through the courts or the Licence Appeal Tribunal (LAT). CPBH found that 85 per cent of consumers lost their appeal at the LAT. “Many people have given up because people can see you can’t win there,” said Somerville.

Lysyk was also critical of Tarion’s senior management reward system that paid out 30 to 60 per cent of executives’ annual salaries in bonuses based on the agency’s profits, which were achieved by minimizing payments to consumers. The approach would be more appropriately taken by the private sector than a government-delegated, not-for-profit corporation, Lysyk said.

Tarion said it accepts all the auditor’s recommendations. It said it has already enhanced disclosure for buyers of preconstruction condos and updated its builder directory. Its executives earned more than $4 million last year, including $769,410 for CEO Howard Bogach. Its directors — many of whom work directly for the building industry — collectively earned more than $500,000 last year.

Opposition MPPs called for tougher penalties for builders and improved consumer protections.

“The entire culture and makeup of Tarion should be consumer protection first and not simply to support the desires of developers and builders, which has been happening for years and years,” said NDP Government Services and Consumer Protection critic Tom Rakocevic (Humber River-Black Creek).

The public interest has to go before “what appears to be a profit-driven incentive structure for senior executives,” said Green party MPP Mike Schreiner.(Toronto Star, Tess Kalinowski)

紅磡「共宅」68呎月租8100元 呎租119元(2019.10.24)

【明報專訊】「愈住愈貴,愈住愈細」成為本港居住「新常態」。Weave Co-Living繼去年8月在太子界限街推出「共宅」Weave on Boundary後,推出第二個「共宅」項目紅磡溫思勞街Weave on Baker,最細單位面積僅得68呎,月租承惠8100元,呎租高見119元,媲美半山豪宅呎租水平。

包Wi-Fi水電煤費等項目樓高23層共涉95伙,採1梯5伙設計,實用面積由68至115方呎,並設有2個連30呎露台的特色單位。項目房型分為標準套房及單人房,其中單人房需3人共用浴室。項目最細單位為C室單位,屬單人房。單位雖小但與其他房間相同,一樣提供儲物空間、小型雪櫃、辦公桌椅、電視等,只是擺放所有家具後,活動空間僅得3個身位。公共空間面積約3000方呎,提供多項設施供租戶使用,如健身室、閱讀室、遊戲室、頂樓天台及露台,洗衣房等;另大廈定期將舉辦多元化的文化活動。

一梯5伙 租期半年起Weave Co-Living首席營運總監朱潔瑩(Liz Chu)表示,項目的房間租期為6個月起,全包式月租由8100至1.4萬元;如租戶選擇1年的租期可獲7%至8%的折扣。租金已包含房租、管理費、政府各徵費、Wi-Fi及水電煤費用,同時定期為住客提供房間整理服務。

她透露,目前項目已接獲逾100宗的預租申請;另項目翻新費逾百萬元,預計入伙日期為下月1日。對於公司未來的計劃,她指下一個共居大廈將設於西營盤,項目樓高約有20多層,惟未有透露面積,項目最快明年第4季推出。

包Wi-Fi水電煤費等項目樓高23層共涉95伙,採1梯5伙設計,實用面積由68至115方呎,並設有2個連30呎露台的特色單位。項目房型分為標準套房及單人房,其中單人房需3人共用浴室。項目最細單位為C室單位,屬單人房。單位雖小但與其他房間相同,一樣提供儲物空間、小型雪櫃、辦公桌椅、電視等,只是擺放所有家具後,活動空間僅得3個身位。公共空間面積約3000方呎,提供多項設施供租戶使用,如健身室、閱讀室、遊戲室、頂樓天台及露台,洗衣房等;另大廈定期將舉辦多元化的文化活動。

一梯5伙 租期半年起Weave Co-Living首席營運總監朱潔瑩(Liz Chu)表示,項目的房間租期為6個月起,全包式月租由8100至1.4萬元;如租戶選擇1年的租期可獲7%至8%的折扣。租金已包含房租、管理費、政府各徵費、Wi-Fi及水電煤費用,同時定期為住客提供房間整理服務。

她透露,目前項目已接獲逾100宗的預租申請;另項目翻新費逾百萬元,預計入伙日期為下月1日。對於公司未來的計劃,她指下一個共居大廈將設於西營盤,項目樓高約有20多層,惟未有透露面積,項目最快明年第4季推出。

Icona condo buyers take developer to court over cancelled project(2019.11.16)

Buyers in the cancelled Icona condos are asking a court to find that developer Gupta Group breached its contract by failing to disclose that its Vaughan property was subject to a legal condition prohibiting it from selling homes on that piece of land.

If the 463 purchasers are successful, they intend to sue for damages from the transaction they say has left them behind in the Toronto region’s high priced housing market.

The Icona condos, two towers with more than 1,100 units, sold out amid frenzied home buying activity in 2017. They were the centrepiece in a residential, hotel and retail development marketed by the Gupta Group.

In September 2018, the condo purchasers received refunds and letters telling them that the project was being cancelled for financial reasons — one of the reasons developers are allowed to cancel pre-construction projects.

They later learned that the cancellation had happened in the wake of a July 2018 court decision that upheld a restrictive covenant that meant the Gupta Group was never allowed to build homes on the land near the Vaughan Metropolitan Centre.

“It is arguable that the reason for cancellation was the restrictive covenant,” according to a summary of the case by lawyer Ted Charney, who is representing the buyers.

“Vendors cannot terminate a condominium project except in certain limited defined situations which are set out in the Tarion Addendum. A restrictive covenant prohibiting construction of the project is not one of the defined situations,” he said.

Knowing about that restrictive covenant would have been “critical” to condo buyers, said Charney.(Toronto Star, Tess Kalinowski)

If the 463 purchasers are successful, they intend to sue for damages from the transaction they say has left them behind in the Toronto region’s high priced housing market.

The Icona condos, two towers with more than 1,100 units, sold out amid frenzied home buying activity in 2017. They were the centrepiece in a residential, hotel and retail development marketed by the Gupta Group.

In September 2018, the condo purchasers received refunds and letters telling them that the project was being cancelled for financial reasons — one of the reasons developers are allowed to cancel pre-construction projects.

They later learned that the cancellation had happened in the wake of a July 2018 court decision that upheld a restrictive covenant that meant the Gupta Group was never allowed to build homes on the land near the Vaughan Metropolitan Centre.

“It is arguable that the reason for cancellation was the restrictive covenant,” according to a summary of the case by lawyer Ted Charney, who is representing the buyers.

“Vendors cannot terminate a condominium project except in certain limited defined situations which are set out in the Tarion Addendum. A restrictive covenant prohibiting construction of the project is not one of the defined situations,” he said.

Knowing about that restrictive covenant would have been “critical” to condo buyers, said Charney.(Toronto Star, Tess Kalinowski)

Ruling to limit Airbnbs ‘huge win for renters’(2019.11.19)

A provincial planning tribunal has rejected an appeal by Airbnb landlords and upheld the city’s short-term rental rules in a decision that is being touted as a “major victory for tenants.”

In his ruling, an adjudicator for the Local Planning Appeal Tribunal (LPAT) rejected landlords’ arguments that short-term rentals were just like any residential use of a home.

He said the city’s Airbnb regulations “represent a reasonable balancing ... ensuring that housing is provided for residents, that a full range of housing is available including short-term rentals, and that the business and tourism economies are supported.”

Toronto council approved the zoning bylaw amendments in December 2017. They were supposed to take effect in

June 2018 but were never enforced because of the appeal at the LPAT.

Under Toronto’s rules, short-term rentals would be allowed only in landlords’ principal residences for up to 180 nights a year for an entire house or apartment. Homeowners could also rent up to three bedrooms year round on a short-term basis — a term defined as less than 28 days.

Homeowners also wouldn’t be allowed to use basement apartments as shortterm rentals. Only the full-time resident of those suites could let those units for less than 28 days.

In a written decision Monday, the LPAT said the city’s approved rules have the potential to return up to 5,000 of Toronto’s more than 21,000 Airbnbs to the long-term residential market.

Those are the units where the property owners are not residing but rather using them exclusively as short-term rentals.

“Even if you return only 3,000, it’s a huge win for renters in Toronto,” said Thorben Wieditz of Fairbnb, a pro-regulation coalition of tenant advocates, community groups, academics and hoteliers that participated in the appeal process.